Foreword

In the tech industry, competition is driving the adoption of a new growth model. Increasing investments make it easier than ever to launch a new business, but the proliferation of new products in the market means it has never been more challenging to achieve growth. A traditional model based on the marketing and sales funnel no longer works effectively to build sustainable growth for subscription-based SaaS. Instead, companies are searching for ways to successfully maximize customer lifetime value by lowering Customer Acquisition Cost (CAC) and improving Net Revenue Retention (NRR)—but do so without drastically increasing spending with high-touch resources. The solution? Make the product itself a key player in the customer lifecycle and experience.

At the center of this new philosophy is product-led growth (PLG). PLG is a go-to-market strategy that transforms the way products are designed and delivered. This strategy puts the product at the forefront of the customer journey to drive conversion, adoption, retention, and expansion. PLG achieves these objectives by leveraging product usage data to deliver immersive product experiences at scale.

With PLG, companies align their products to the customers’ needs at every stage of their journey. From delivering early value using free trials and freemium models, to driving product adoption that accelerates time-to-value and stickiness, this strategy produces engaged customers who are much more likely to be retained and primed for expansion. Growth-minded companies are looking to PLG strategies to help achieve maximum customer lifetime value—it’s not a question of if, it’s a question of when your company will adopt this model or get disrupted by it.

While not effortless to implement, PLG leads to stronger units of economics, like Net Dollar Retention (NDR), Gross Revenue Retention (GRR), and CAC. This model uses the product as the primary vehicle to drive end-to-end value realization, build consumption-based pricing, prioritize the product roadmap to optimize customer outcomes, and unlock organic expansion using self-serve provisioning.

We have seen companies achieve durable growth and success by deploying a PLG model across different market segments in B2B and B2C. We wanted to track and understand where companies across all verticals fall on the PLG spectrum. Along with RevOps Squared, a benchmarking research firm, we surveyed over 600 companies of various sizes, with varying annual contract values and across multiple industries, to learn about their journeys towards implementing PLG strategies. We wanted to discover what solutions they use and how they measure success.

The results were some of the most insightful data we’ve seen in some time. Here are a few of the results we found most interesting:

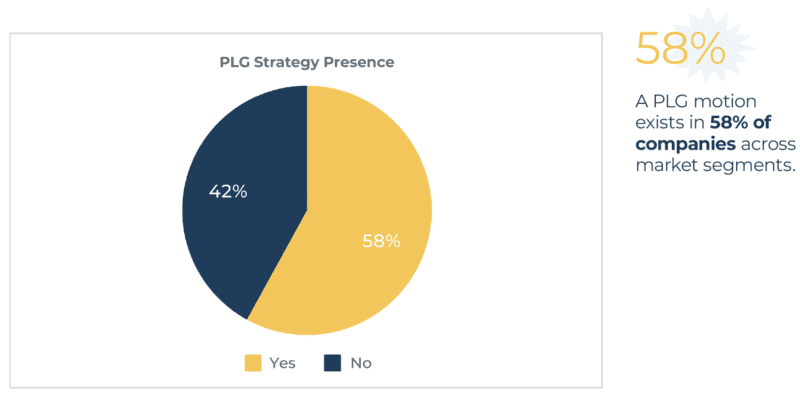

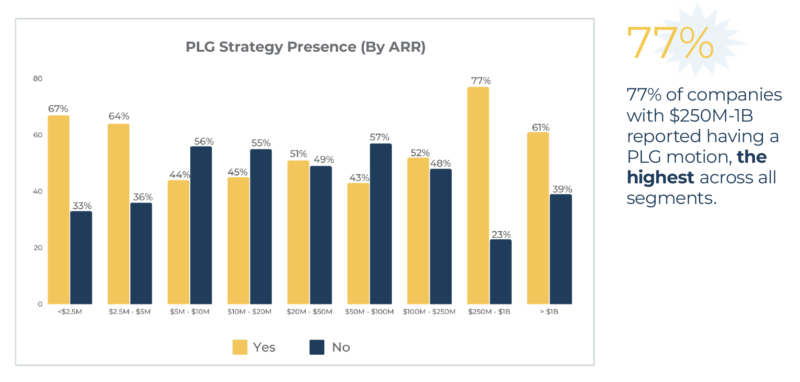

- A PLG motion already exists in 58% of surveyed companies. The majority of organizations surveyed have already started a PLG motion, regardless of size or product type, with 40% having greater than $25K annual contract value (ACV).

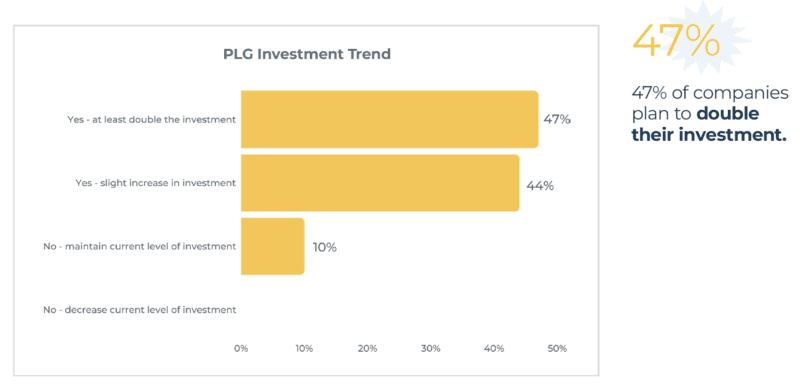

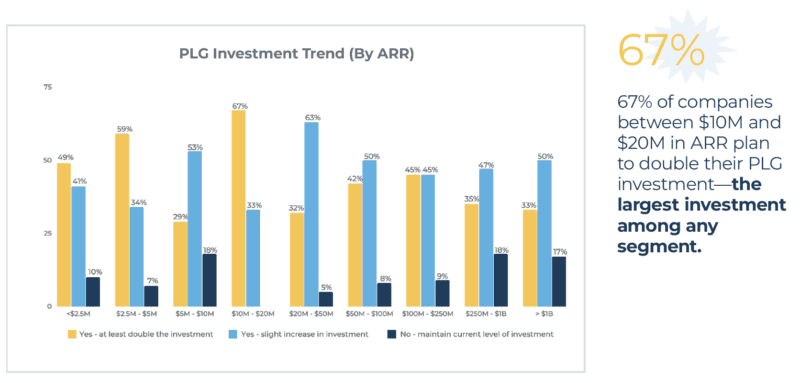

- 91% of companies adopting PLG plan to increase their investment in PLG. 47% plan to double their investment.

- Of companies that use product experience data, 57% use it to develop product roadmaps. More and more we’re seeing that the best product teams don’t hedge bets—they use data to define their decisions.

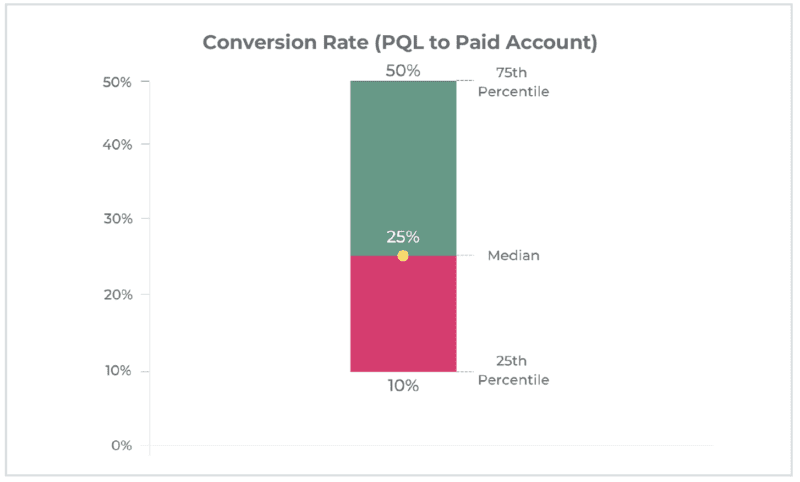

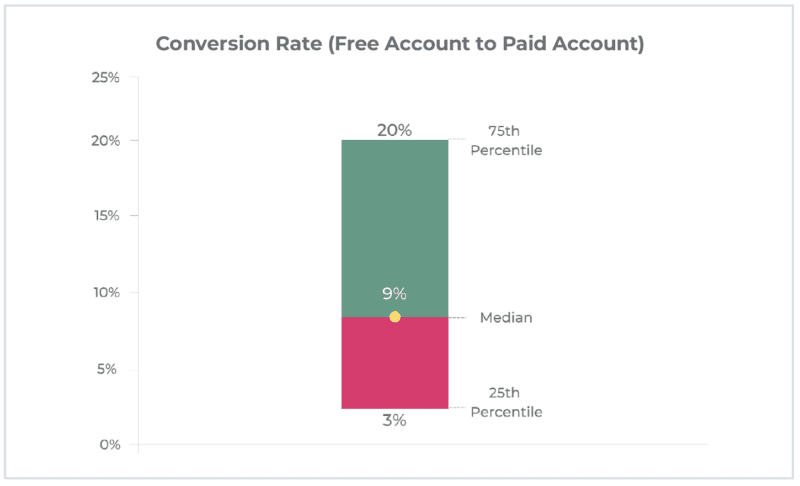

- Free trials using Product Qualified Leads (PQLs) convert to paid customers on average 25% of the time. Compared to only a 9% conversion rate (median) from free accounts to paid accounts, companies using PQLs see better results and improved sales opportunities.

We’ve included current data on the state of PLG, the defining metrics, and the tools companies are using to leverage their new strategies. We hope that you find this information not only useful but inspiring as you set your growth goals for 2022 and beyond.

Mickey Alon

Chief Technology Officer of PX, Gainsight

Key Findings

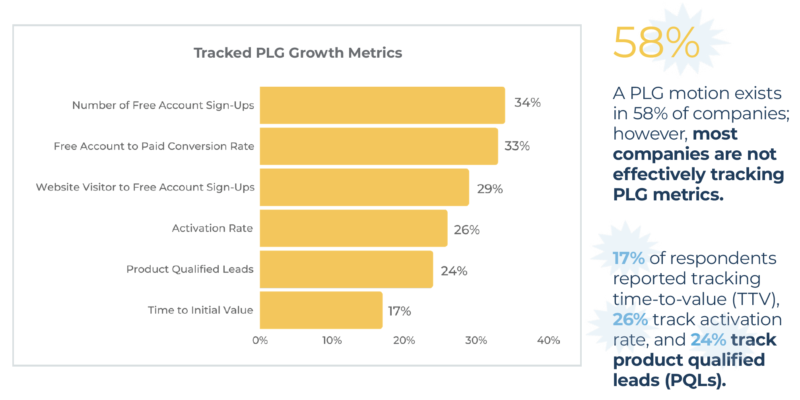

A PLG motion exists in 58% of companies; however, most companies are not effectively tracking PLG metrics. 17% of respondents reported tracking time-to-value (TTV), 26% track activation rate, and 24% track product qualified leads (PQLs).

36% of respondents use product usage data to predict churn. 38% leverage usage data to identify expansion opportunities.

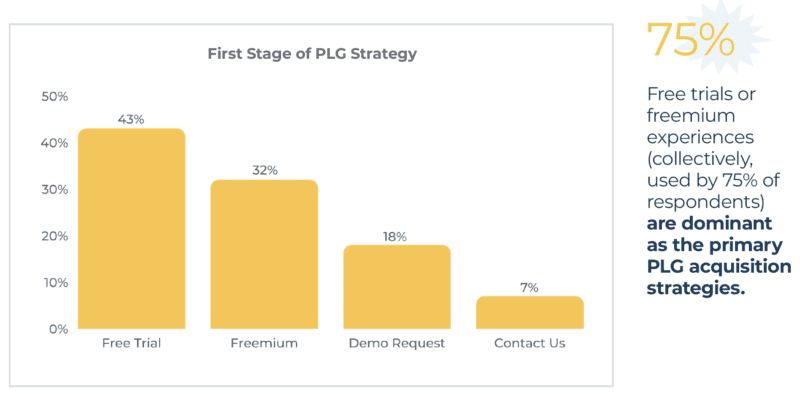

43% of companies use free trials to optimize their customer acquisition. 32% applied a low-cost or freemium model as part of a land-and-expand motion.

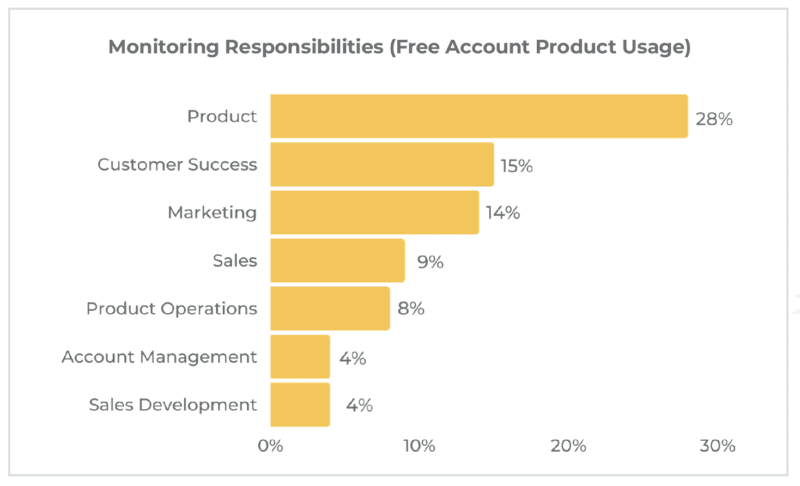

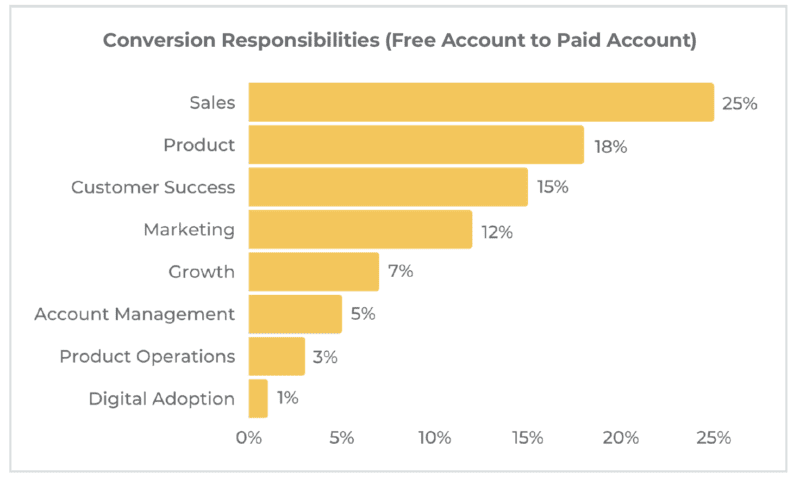

The Product organization is responsible for monitoring free account customers in 28% of cases, and converting free accounts to paid in 18% of cases. Conversely, sales is involved in conversion 25% of the time.

Nearly half (46%) of respondents reported leveraging in-product engagement tools, meaning most companies are not yet leveraging their product as a conduit to their users by creating personalized experiences.

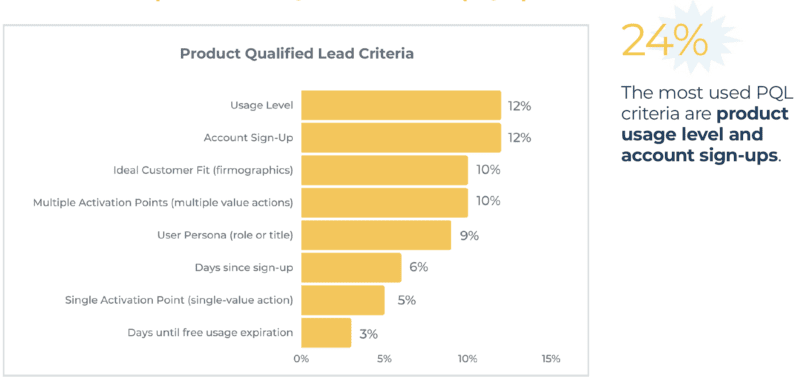

The criteria for a PQL are highly variable. Only 24% of respondents agreed that usage level and account sign-ups were important criteria for identifying PQLs.

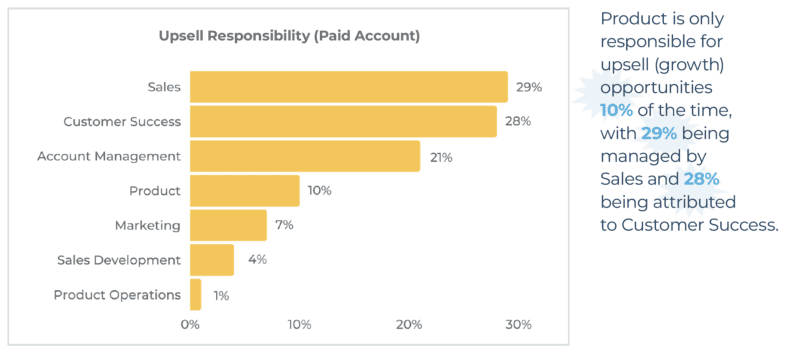

Product is only responsible for upsell (growth) opportunities 10% of the time, with 29% managed by Sales and 28% attributed to Customer Success.

The State of Product- Led Growth

Majority of Companies Are Adopting Product-Led Growth

91% of Companies With a PLG Motion in Place Plan to Increase Their Investment in PLG

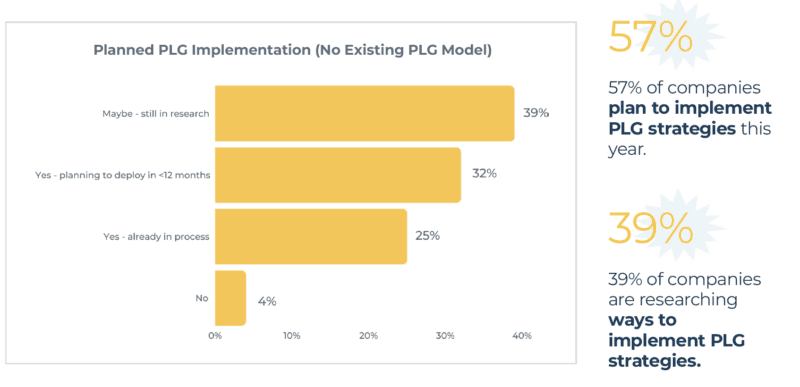

Almost All Companies Without Existing Product- Led Growth Models Will Invest This Year

Mickey’s Take “In terms of both investment and implementation, an overwhelming majority of companies are committed to PLG. It’s clear companies understand that in order to reach their revenue goals, the focus must be on ways to use the product to improve the customer experience.”

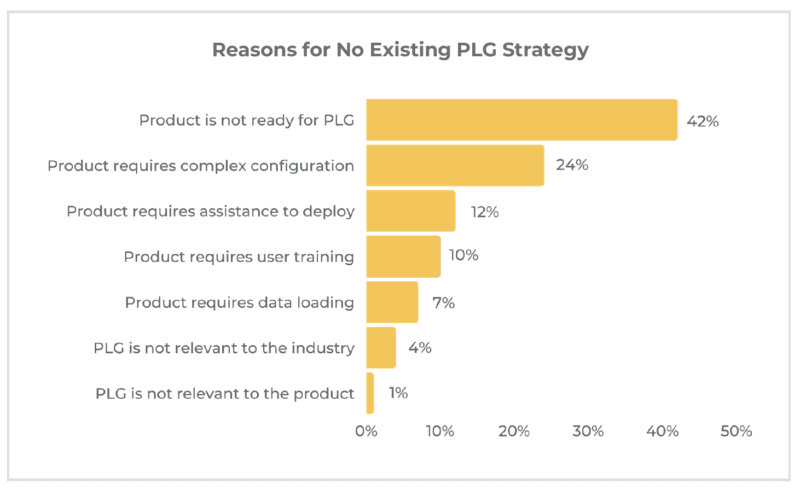

Product Teams Must Lead Company-Wide Product-Led Growth Initiatives

42% of respondents without PLG strategies cite product readiness as the primary reason.

24% of respondents cite product complexity as the roadblock for implementing PLG strategies.

Only 4% reported PLG as irrelevant to their industry.

Mickey’s Take “While most companies realize the need to adopt PLG strategies, they are not always in the best position to do so due to heavy product investment tied to provisioning and onboarding complexity. This is an opportunity for companies to start with PLG strategies focused on optimizing retention and expansion. With the right data, Product Managers can identify and eliminate friction points around usability of core features, increase feature awareness, and drive product adoption, which ultimately leads to revenue growth.”

Free Trials and Freemium Experiences Dominate Product-Led Growth Strategies

Mickey’s Take “Freemiums and free trials are established tactics for businesses to scale customer acquisition without being tied to high-touch sales resources. But opportunities abound to increase product engagement in all stages of the customer lifecycle and positively impact business outcomes—not just with existing freemium or free trial programs. To do this, Product teams need to implement better tools to influence all stages of the customer journey, and establish programs to better support other business functions by using the product as a primary driver of adoption, retention, and growth. This is why Product, Sales, and Customer Success teams need to be BFFs. ”

Freemium is a product-led growth strategy where a company provides a potential customer free access to a limited number of features within their product. While they can use the limited version of the product as long as they want to, they can only access additional features by upgrading to a paid account.

A free trial is a product-led growth strategy where a company provides a potential customer unlimited access to the features of their project for a limited time. Typically, these are 30-, 60-, or 90-day periods, after which the potential customer either upgrades to a paid account or loses access to the product.

Product-Led Growth Responsibilities

Companies Need Broader Organizational Alignment in Order to Realize the Full Potential of Product-Led Growth Strategies

The Product organization is responsible for monitoring free account customers in 28% of cases and converting free accounts to paid in 18% of cases.

Conversely, Sales is involved in conversion 25% of the time.

Mickey’s Take “A general increase in conversion rates may need to be supported by broader organizational alignment around PLG acquisition motions, particularly between Product, Sales, and Customer Success teams. There is an opportunity to bridge the gap between monitoring and conversion by aligning cross-functional teams around the customer journey.”

90% of Companies Can Increase Revenue by Involving Product in Upsell Opportunities

Defining Metrics of Product-Led Growth

Product-Led Growth Metrics Tracking Is in Its Infancy

Mickey’s Take “The current lack of data collection indicates an opportunity for product teams to sharpen their focus on buyer behavior to improve conversions. Metrics on time-to-value, free account sign-up, organic and inorganic acquisition channels, and lead-to-conversion represent a small fraction of the data on trial experience that could be leveraged for better revenue growth.”

Time-to-value measures how long it takes for your customers to derive value from your product after they purchase it. The faster your product solves their unique pain points, or helps them achieve their specific business goals, the better the customer experience and the higher the lifetime value of a customer will be.

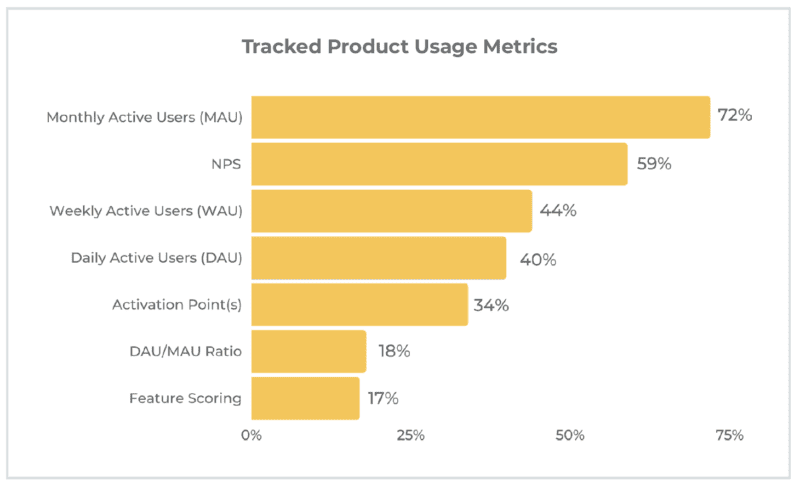

Product Usage Metrics Are Leading Indicators of Business KPIs

Mickey’s Take “Monthly, Weekly, and Daily Active Users are common, single-variable metrics that seldom effectively predict customer retention probability. Core feature adoption and user sentiment, on the other hand, take the single-variable data points and analyze them in the context of value actions and feature usage. Your team can use this analysis to pull insights for a data-driven product strategy that aligns with customer outcomes and revenue growth.”

The difference between product usage data and product experience data is small but critical. Product usage data tracks raw behavior, such as clicks, sessions, etc. This data is useful but does not allow for meaningful analysis. Product experience data combines a wider data set, such as user sentiment, that allows teams to pull insights about intent, quality of user’s customer journey, and effective ways to expand each user’s product adoption.

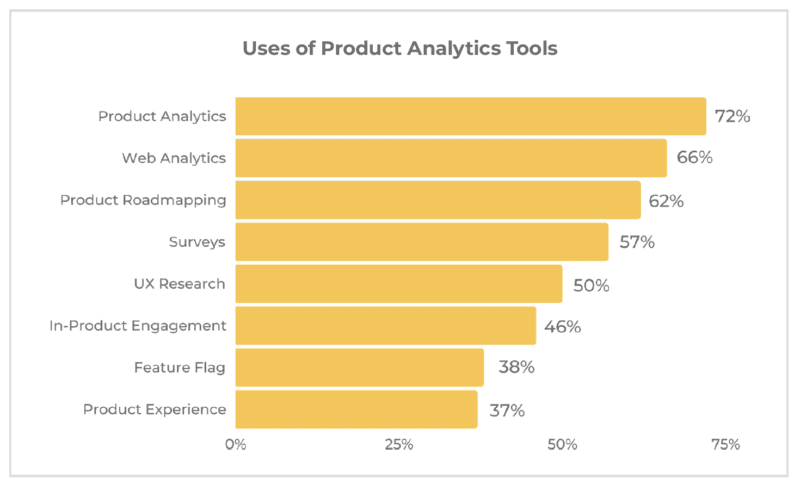

Product Teams Prioritize Analytics, Surveys, and In-Product Engagement to Drive Product Strategy

72% are using product analytics to gain visibility to usage data.

57% use surveys to conduct user research and feedback.

46% use in-product engagement to drive adoption.

Mickey’s Take “Even as companies are getting richer in data, the actionability of that data is still challenging, as most are using a set of point solutions that often lead to disparate data sources and user fatigue, and make it difficult to close the loop by driving personalized user experience to the right user at the right time. Product experience platforms are designed to collect product usage data and unify it with customer experience data, while making it triggerable for in-product engagement.”

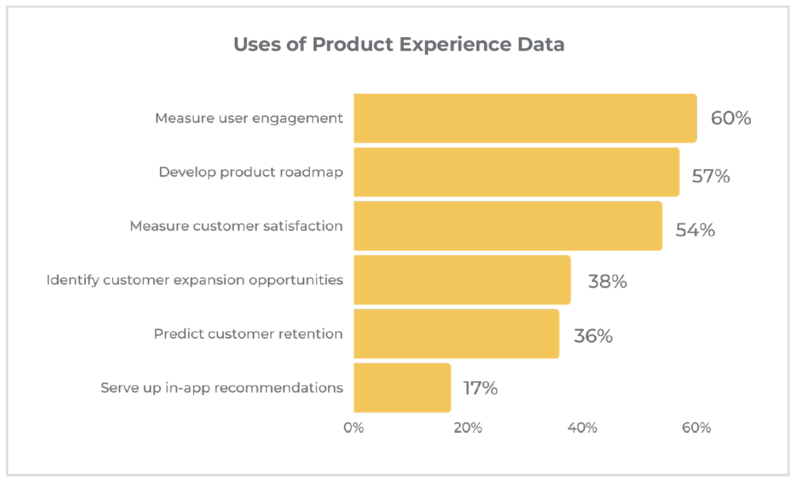

Companies That Use Product Experience Tools Increasingly Leverage the Data to Build More Informed Product Roadmaps

Of companies that use product experience data, 57% use it to develop product roadmaps.

Only 36% of respondents use in-app data to predict retention, and 38% use in-app data to identify expansion opportunities.

Only 17% of respondents use data to serve in-app recommendations.

Mickey’s Take “Roadmaps that leverage product experience data are typically more successful and impactful because they prioritize the right features, identify customers at risk, and provide the foundation for a durable product-led growth strategy. It’s true that the best product teams don’t hedge bets—they use data to inform their decisions. Right now, there is a huge growth opportunity for companies not using product usage data to deliver cohesive product experiences that lead to stronger retention and expansion.”

Product Qualified Leads (PQLs) Must Be Better Defined to Improve Sales Qualified Leads (SQLs)

Free Trials Using PQLs Result in 2.8x Higher Conversion Rate Than Freemium

Use of PQLs dramatically improves free to paid account conversion rates

Mickey’s Take “While most PLG strategies offer free accounts, they are often not used effectively. Free accounts not only hook new users, they can also accelerate deal cycles by enabling sales teams to engage with users that demonstrate a propensity to buy. A PLG strategy that uses these PQLs will convert accounts at a significantly higher rate.”

Final Thoughts

The business opportunities and growth potential available to companies that focus on PLG initiatives are immense. Product-led growth companies are now growing at a rate that is 2x faster than traditional SaaS companies. Yet, PLG is still very aspirational for most businesses. Thus, the future success of many organizations will rely on Product organizations more than ever. This will require Product teams to not only lead in product development, but in driving cross-functional business outcomes that put the product at the center of the customer experience, from acquisition to expansion. While the data in this report shows that some standardization and reorganization are necessary, companies are committed to making investments to drive core business KPIs—such as CAC, GRR, and NRR—that are tied to the company’s overall valuation.

We found that understanding and tracking PLG metrics is in its infancy; however, businesses both with and without a PLG strategy are beginning to track important product data points as leading indicators for retention and expansion.

In addition to tracking basic product metrics only some of the time, businesses may not have the right product stack in place. Only 37% of respondents reported using a product experience tool, while 66% of companies are still using web analytics to measure product performance. This limited approach leaves out some of the more critical elements required to drive a PLG strategy. Product experience tools vary in their ability to collect the right type of data to inform product decisions, and opportunities exist to deploy better systems to contextually gauge user experiences.

Additionally, less than half (only 46%) of respondents reported leveraging in-app engagements, meaning most companies are not yet leveraging in-app messaging with their customers to create engaging experiences, accelerate time-to-value, and speed the adoption of sticky features.

Interestingly, most respondents reported using a wide range of tools within their product, meaning they are managing an exhaustive tech stack to conduct various independent functions such as surveys, UX research, analytics, and in-app engagements. With a wide range of tools needed, product managers may face challenges to create compelling and cohesive user experiences in-product.

Free trial or freemium experiences (collectively, used by 75% of respondents) are dominant as the primary PLG acquisition strategies, likely because many companies, even without an official PLG strategy, use them for customer acquisition. Free trials are more common than freemium in products with higher ACV and deeper feature sets. The free trial conversion rate is higher than the free-to-paid model, which means freemium requires a high volume of subscriptions that might take a longer time to convert.

The most exciting takeaway from all the data is that there is still so much opportunity for PLG to drive durable growth for SaaS businesses. As businesses mature their PLG strategies, the result will be a stronger unit of economics and progression beyond acquisition-led growth to retention- and expansion-led growth. In the subscription business, the traditional marketing funnel will be replaced with a flywheel that allows companies to deliver value that meets the customer’s expectations at every stage of the customer journey. Shifting toward more incremental revenue by leveraging consumption-based pricing tied to outcomes will allow you to organically grow with your customers. We look forward to seeing these numbers climb in next year’s report.

Methodology

Gainsight, in partnership with RevOps Squared, conducted research between December 2021 and February 2022 to benchmark product-led growth efforts, including presence, responsibilities, and performance measurement.

Over 600 companies participated in the research across a wide range of company sizes, annual contract values, industry segments, and geographic locations. Participants included every level of management, including C-Level executives, Senior Vice President, Vice President, and Directors, both inside and outside of the Product department.