- Products

- Pricing

- Solutions

-

-

By Use Case

- Digital Customer SuccessScale effort and align teams using digital-led strategies.

- HealthcareDeliver proactive, preventative care that enables you to retain and grow your customer base.

- Start and Scale FastEssential features and onboarding to help you start and scale with Gainsight in as little as two weeks.

- Scale and EfficiencyDeliver outcomes without adding headcount.

- RetentionPredict churn and address risk.

- ExpansionIdentify and align on expansion opportunities.

- Product AdoptionProactively guide users to value.

-

By Team

- Customer SuccessEmpower and enable your CSMs.

- ProductCreate elegant product experiences.

- Customer ExperienceIdentify trends across the customer journey.

- Revenue and SalesDrive a high performing renewals process.

- IT and AnalyticsConsolidate your Customer Data.

- ExecutivesAlign on customer health and opportunities.

- Community TeamsBuild a modern customer community.

-

-

- Customers

- Resources

- The Latest from GainsightWhat’s new? From blogs to webinars, to guides and more.

-

-

Gainsight Essentials

The Gainsight you know and love just got a whole lot easier. Start and scale with Gainsight - and go live in as little as two weeks! What are you waiting for?

Check it Out- By TopicWe’ve got it all organized by Product, Customer Success, and Community.

-

-

Pulse 2023

Pulse 2023 is more than software’s biggest conference on durable growth. It’s a celebration of ten years of joy, and an invitation to ask what if about a future that’s yet to be written.

Check it Out- Customer ResourcesFind the Gainsight community, certifications, and documentation.

-

-

Gainsight Digital Hub

Create a single destination for your customers to connect, share best practices, provide feedback, and build a stronger relationship with your product.

Check it Out- Industry ResourcesFind a job, discover Pulse, and learn what’s happening industry-wide.

-

-

Industry Resources

- Customer Success Job Board

- Pulse Plus

- Pulse Conference

- Pulse Library

-

Pulse 2023

Pulse 2023 is more than software’s biggest conference on durable growth. It’s a celebration of ten years of joy, and an invitation to ask what if about a future that’s yet to be written.

Check it Out- Essential GuidesIf it’s here, it’s essential knowledge on CS, PX, and community.

- Company

- Impact

- Login

- Schedule a Demo

- Essential GuidesIf it’s here, it’s essential knowledge on CS, PX, and community.

-

- Industry ResourcesFind a job, discover Pulse, and learn what’s happening industry-wide.

- Customer ResourcesFind the Gainsight community, certifications, and documentation.

- By TopicWe’ve got it all organized by Product, Customer Success, and Community.

-

- The Latest from GainsightWhat’s new? From blogs to webinars, to guides and more.

- Products

- Pricing

- Solutions

- Customers

-

Resources

- The Latest from Gainsight

- By Topic

- Customer Resources

- Industry Resources

-

Gainsight Essential Guides

- Quarterly Business Reviews (QBRs)

- Customer Success

- Voice of the Customer

- Customer Success Management

- Customer Journey and Lifecycle

- Professional Services Success

- High Touch Customer Success Management

- Company-wide Customer Success

- Recurring Revenue

- Channel Partner Success

- Product-Driven Customer Success

- Churn

- Budgeting for Customer Success

- Product Analytics

- Customer Experience

- Business Metrics

- Choosing a Customer Success Solution

- Product Management Metrics

- Company

- Impact

- Login

The Essential Guide to

Customer Experience

If you’ve read anything about customer success on this website, you’ve probably seen this definition: “Customer success is when your customers achieve their desired outcome with your product or service.” It’s not uncommon that people mistakenly confuse “happiness” with success. In other words, customer success is not about happy customers—it’s about successful ones. Why the distinction? Critically, customer happiness, or as we’ll refer to it in this guide, customer experience (CX), isn’t strongly correlated to renewal and retention, the core financial goals of the customer success movement. Achieving the customer’s desired outcomes is the only way to ensure they come back and buy more with every renewal.

In the world of Business-to-Business (B2B), these desired outcomes have historically often had a completely independent relationship with CX. They’re often owned by completely separate teams. In many cases, customers have terrible experiences with their vendors, yet keep renewing every subscription period.

But that’s changing. In this essential guide, we’ll look at the relationship between CS and CX and understand at a strategic and tactical level how to improve CX to deepen your relationships with clients with the ultimate goal of driving both long-term and short-term growth.

Chapter 1

Customer Success = Customer Experience + Customer Outcomes

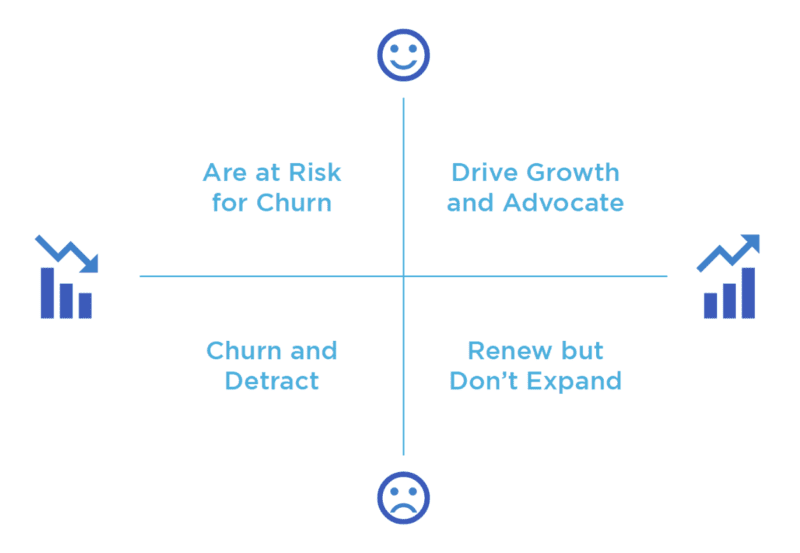

At Gainsight, we think about customer success across two vectors. They’re interconnected so deeply that we can talk about them separately, but practically, they can’t be separated. Those vectors are the customer’s experience and the customer’s outcomes. Together, they equal customer success, or as expressed as an equation:

CS = CX + CO

Because each one is impacted through every interaction your customers have with your company—both in the product and out—they’ll always be intrinsically linked. But they can be understood individually using this two-by-two.

The top-right and bottom-left quadrants are pretty self-explanatory. If you have great outcomes and experiences, you’re doing great! If they’re both bad, you need to fix them—fast. But many companies find themselves in one of the other two quadrants, and each presents unique challenges and opportunities.

We see this scenario often: you have fantastic relationships with your customers. They rave about you, they seem happy, they leave good reviews online, and then… they churn. Often without warning. It doesn’t matter how great your experience is; if you’re not delivering on your customers’ desired outcomes, it’s just a matter of time before they leave. You can read all about how to get your customers to those outcome in the Essential Guide to Customer Success.

But we need to talk about the inverse: when your customers are achieving their desired outcomes but they have a negative customer experience.

This is a common scenario. You’re getting what you paid for, maybe you’re seeing good or even great returns on your investment. But it’s frustrating. Maybe the product or service is just really challenging to use, maybe your interactions with the vendor are difficult or unsatisfying. You feel trapped. This is a common feeling with ISPs, insurance companies, and utilities. In any market where there’s either not a lot of competition or the friction to leaving is high, you’ll often run into this issue.

But if this is your market, why should you care if your customers feel trapped? If they’re renewing and the revenue is there, should you invest in improving experience?

Chapter 2

Why CX is important

Without an elite customer experience in place, your customers may renew, but they won’t expand. This bears out in the data. Net Promoter Score (NPS) is one of the most common feedback metrics for benchmarking (among other things) customer experience. It turns out that NPS doesn’t correlate to churn at all, but it does correlate to growth—specifically a high NPS score indicates an opportunity and likelihood to expand.

Growth through expansion is one of the most important upsides to the subscription business model. In business-to-business, this is even further amplified. As your customers grow and become more profitable, they should be scaling alongside you. But if they don’t like doing business with you, they will not grow their investment proportionally. In fact, they’re more likely just biding their time until they can either accomplish what you sell them internally (a build vs. buy scenario) or until you’re disrupted by competition.

On top of that, poor CX hurts your ability to sell to new customers as well. After all, when was the last time you gave a great online review to a business where you had a bad experience? Online reviews are a cornerstone of any buyer’s journey in this era—regardless of market. Investing in CX will 100% have cascading benefits on new logo acquisition in addition to expansion within your customer base.

Oracle conducted research on the effect of CX and found that:

- 46% of consumers were pleased when an organization responded to a customer’s negative comment.

- 89% of consumers began doing business with a competitor following a poor customer experience.

- 24% of consumers who had unsatisfactory service interactions shared their experiences through social networks in 2010.

What does it mean to invest in CX

It’s one thing to say the customer’s experience is important, but how do you operationalize it? It’s all about feedback. You can’t simply tell your teammates to improve CX without having a roadmap for doing that, and the process is simple:

- Listen to your customers.

- Act on their feedback.

- Analyze the results.

- Iterate and reiterate.

A business that is deeply committed CX with every interaction is necessarily process-driven about engaging with customers through these four steps—across all functions, roles, and hierarchies.

What does it mean to invest in CX

It’s one thing to say the customer’s experience is important, but how do you operationalize it? It’s all about feedback. You can’t simply tell your teammates to improve CX without having a roadmap for doing that, and the process is simple:

- Listen to your customers.

- Act on their feedback.

- Analyze the results.

- Iterate and reiterate.

A business that is deeply committed CX with every interaction is necessarily process-driven about engaging with customers through these four steps—across all functions, roles, and hierarchies. To invest in CX is to invest in the processes whereby each teammate can get feedback on every interaction with the customer, understand where you’re succeeding or failing, follow prescriptive playbooks to solve the problem, close the loop with the customer, and repeat the process to benchmark progress.

How CX strategy relates to CS strategy

Your CX strategy needs to be deeply integrated to your CS strategy. In many companies, CX is owned largely by Marketing teams as a function of their proficiency with one-to-many communications systems. But the natural home of CX from a goal perspective lies with the department whose job it is to deepen and strengthen customer relationships—in other words, the customer owner should own CX. In most modern companies, that means the Customer Success team.

With the right tools, a CS team is better equipped to collect feedback at key touchpoints and put it into action with zero layers of abstraction at each interaction. They’re the closest to the customer and have the highest leverage on key CX metrics (we’ll cover those metrics further on in the Guide).

Closing the gap between CX and CS has tons of downstream benefits for enhancing customer outcomes as well. You’ll get the answers to critical questions like:

- Is our product easy to consume?

- Are we truly creating value?

- How do you define success?

- Are we helping you achieve that definition?

Those answers help you prioritize actions, get prescriptive with customers, and deepen the specificity of your customer interactions. But it’s important that CX—like CS—doesn’t get pigeonholed as a purely departmental activity. CX is what happens at every interaction your customer has with your company. That means Support needs to be aligned. Sales & Marketing need to be aligned. Above all, Product teams need to be aligned. Your most consistent and meaningful interactions are happening inside the product. Are your product managers on the same page as your CX managers?

Read our Essential Guide on Product Experience to get best practices for ensuring CX inside the product.

Chapter 3

Fundamentals of Programmatic CX

When we talk about CX processes we’re talking about a lot of different actions:

- Conducting surveys

- Analyzing data

- Developing playbooks

- Running those playbooks

- And more

But it doesn’t help to start with the tactical if you don’t have a holistic strategy in place. We’ve broken it all a simple, three-step strategy that can serve as a foundation for your CX tactics.

- Feedback: Capture insightful feedback by giving your customers frequent opportunities to submit feedback.

- Workflows: Follow up promptly so customers know that they are heard. Quicker response to customer feedback results in a greater impact.

- Insights: Assess progress against goals and measure improvement to keep the program on track.

None of this is possible without technology. At Gainsight, we’re not agnostic to that fact, but this Guide won’t serve to push our products on you. However, it does assume that you’ll need software tools to accomplish even the barest minimum. At various stages of scale, different toolsets will have different advantages and disadvantages. But that is the key word: scale.

In a face-to-face retail environment, one human can just ask every customer how they’re doing, how their experience is, whether they’ll come back, etc. You could even read it on their face. That’s not the world we live in anymore—even in retail! CX software automate repetitive tasks, from reaching out to thousands of customers to aggregating feedback.

The 3 Processes of CX

While these three processes are necessarily reductive, we’ve found that boiling CX down to a more concise strategy helps solve the two main challenges of ensuring great customer experiences: consistency and speed.

It’s not a challenge to make sure a few customers have a concierge-level experience some of the time. And it’s likewise easy to get it right on an infinite timeline. But in the real world, elite CX is great 99% of the time—and it happens simultaneously with every interaction.

And practically speaking, as we’re talking about feedback and data, those two qualities are paramount! Consistent surveys (for example) will generate consistent data for benchmarking purposes. Speedy responses will likewise mitigate negative experiences and capitalize on the value potential of positive ones.

Process 1: Feedback

The information you collect in this step will deliver the blueprint for the entirety of your CX operation. So, not to overstate the challenge, but this is the most important step—if you get the wrong feedback, you’ll take the wrong action, even if it’s the “right” action. Getting the “right” feedback depends on three things: asking the right person the right question at the right time.

Right person

Every person is unique, but every survey can’t be. Some effort needs to be made to understand your customer base as cohorts. That means building persona profiles that exemplify the types of customers or users you have that can align meaningfully to survey questions. Building standard personas helps to easily define who is involved with your product and the level of their interaction. This takes the guesswork out of finding the right person to answer your questions. For example, you don’t want to ask end users who weren’t involved in the buying decision about how easy it was to work with your Sales team to purchase the product. And you don’t want to ask procurement people who don’t use the product about feature performance.

Right question

It makes it so much easier to formulate effective questions once you’ve built out your persona cohorts. But now what do you ask? A good first principle is that you should never ask a question you aren’t ready and willing to take action to solve. Surfacing an issue you don’t have intention on fixing will damage your client relationships. That said, there are two main types of feedback this Guide will look at:

- Direct feedback: This is feedback received directly from clients, commonly through surveys. This includes NPS scores, lifecycleCustomer Satisfaction (CSAT) scores, transactional CSAT scores, community posts, etc.

- Indirect feedback: This is feedback generated by the ways clients are engaging with your product. For example, usage data, support data, and other behavioral metrics.

It’s not good enough to just have one or the other. Having both indirect and direct feedback gives you a much more comprehensive picture of the customer’s experience. They work together to fill in the blanks that would be left if you only relied on one type of feedback. For example, someone could send in direct feedback in the form of a negative NPS score, but not give any other feedback explaining why they chose that answer. Taking a look at their indirect feedback, you notice that they have multiple support tickets that concern a particular aspect of your product. You can make a very good guess that their unhappiness is a result of the trouble they’ve had with that part of your product and start a dialog based on that. And in the aggregate, it’s much more than a guess—it’s a diagnosis.

Right time

Timing is everything. Did you know you can meaningfully—even drastically—skew the results of a survey or questionnaire depending on when you send it? Unscientific pollsters have used this to intentionally pitch data to get the results they want, but that’s not what we want. We want accurate and insightful data.

Timing also makes a huge difference when it comes to response rates. Volume of responses will be a big help in making sure your results are meaningful as well. So you want to align your surveys to important milestones in the customer journey. Not only will you get better response rates and more meaningful data, but you’ll also derive helpful and prescriptive steps to solve problems exactly where they arise.

Here are two best practices:

- Send out a survey within a few days of the end of implementation to get the customer’s immediate sentiment about the process and learn how comfortable they are now that they’re effectively “flying the plane.”

- Follow up every support ticket with a one-question survey to close the loop. Ask if they’re satisfied with the support they received so you can find out whether or not you need to reach out and offer additional help.

So, you’ve created personas, decided what feedback you want, and identified ways to ask for it. Before we send you off to the next step, there’s one last thing to keep in mind: the bane of CX professionals (and marketers)—survey fatigue. This can happen when you send too many surveys in a small span of time or you fail to set an accurate expectation for the amount of time your survey will take. Here’s another set of best practices:

- Set a reasonable cadence for how many surveys each cohort should be sent over a given period of time. This could be as frequent as four times a year, depending on the trigger and the audience. Some cohorts will expect monthly outreaches, but many will get fatigued before then.

- Keep the surveys short. If it’s longer than one question, tell people exactly and accurately how much time and how many questions. It’s their time you’re taking.

- Give them the value proposition. If you’re doing CX right, the survey will result in meaningful action that will make life better for the customer. Tell them how this outreach will be worth it for them.

- Keep the questions relevant, focused, and non-repetitive.

Process 2: Workflows

This sounds intutitive, but you’d be surprised how many companies send out surveys but never take any action on them. These actions don’t need to take lengthy review processes, in fact it’s better to respond quickly and at a grassroots level.

Act immediately

In CX, you don’t want to collect a survey response, discuss it in committee, send it to a consultant, lose it, dredge it up months later, and build a four-year strategy around it. Best practice: act immediately to address the concern and fix the problem. And definitely don’t wait for the third process to close the loop! Respond quickly to make the most of the situation, whether it’s positive or negative. An unanswered positive response is just as wasteful as an unanswered negative one. In NPS terms, we call a positive responder a “promoter,” and that’s not a jargon word. If someone indicates that they would “recommend your product or service to a friend or colleague,” they probably would—but they’re not going to without a prompt from you. The longer you wait to thank them and give them an advocacy opportunity, the greater chance they’ll slip into becoming passive status or worse, become a detractor.

Use playbooks to scale

Let’s say you have a thousand customers. You send out a survey. If you follow our advice, you’re trying to respond to hundreds of responses “immediately” which is just impossible to do one by one manually. If you want to scale, you need a set of playbooks. All that means is a standardized set of best practices that your team can use to streamline how they address customer feedback. You can break these playbooks out by level of touch, type of response, and many other vectors. They can even be automated to huge degrees in this day and age.

Any CX or CRM software will be invaluable in building out these playbooks. These days, there are several platforms and any number of stacks designed to scale these types of responses. For your outreach team, your CRM reveals insights about a customer’s health which can then be used as talking points. Instead of having to rely on their own instincts when mediating situations, pre-populated emails give team members confidence and save them time. Keeping support documents organized and easily accessible enables team members to quickly share them with customers in need.

Create a CX-driven culture

In order for feedback to become reality, your entire company, from Sales to Services to Product, needs to view the customer experience as a priority. We’ve seen more established companies struggle with this transition. It’s not enough to hear a fiat from the CEO to somehow become customer-centric. It’s going to take a top-down effort in concert with an operational approach as well as individual buy-in from the people who work closest to the customers day in and day out.

In his famous “customer obsession” letter to Amazon shareholders, Jeff Bezos outlined his strategy for this kind of company-wide focus on CX. Read it here for some insights into bringing customer-centricity to a large corporation.

Process 3: Insights

You’ve asked for feedback. You’ve taken action and closed the loop. Now it’s time to learn and improve going forward. We think about this insights process across three vectors: business analytics, outreach analytics, and program insights.

Business analytics includes all the metrics you want to track and benchmark against. It’s for internal use and will give your teams something to report on and be held accountable to. Data in this bucket can include NPS trends and follow-up response time. For example, track your NPS score to see how it trends quarter over quarter.

Outreach analytics reflect the performance of your customer outreach attempts. You can take these metrics and use them to optimize your outreaches against industry benchmarks. Examples include the performance of surveys, the number of recipients, the number of emails sent/bounced/clicked, and unsubscribes. Combine direct and indirect feedback to create a holistic health score across subjective and objective measures. This health score will give you a high-level view of customer health and enable you to easily identify at-risk customers.

Learn more about How Gainsight Refined Their Customer Health Scorecards in the New Economic Climate.

An important metric to keep an eye on is the number of people who didn’t respond to your survey. Unless this number is jarringly low, it’s sometimes overlooked. Don’t ignore it. Instead, dig deeper. Maybe you need to change your messaging, or perhaps certain people aren’t interacting with your product at all and you need to find a way to engage them. Outreach analytic data is powerful and tells a story, all you need to do is look at it at different angles to glean a wealth of insights.

Program insights are gleaned from both business and outreach analytics. Use these insights to identify strategic priorities to improve your overall strategy. For example, text-based answers can be extremely valuable but hard to analyze at scale. Some software, like Gainsight, have analytics tools baked in that help to extract tone and intent. Using this technology, identify themes in feedback to get a better overall view of your customer experience. Then, apply these learnings to your strategy and track your results.

Chapter 4

What sets Gainsight CS apart?

Okay, if you’ve read this far, be warned: we’re about to make a software recommendation in good faith. There are lots of tech tools out there to bolster your CX processes. So far we’ve been 100% focused on pure best practices you can do regardless of your company size, scale, or tech stack.

But Gainsight CS is our preferred CS platform—it’s the one we use ourselves here at Gainsight with all of our customers, and it works really well.

It’s because Gainsight CS is an end-to-end, purpose-built CS platform. It’s more than just a survey builder. It’s a suite of applications that enable companies of all sizes to close the loop, act on feedback, and work towards proactively and consistently delivering a great customer experience. In fact, Gainsight CS is often the best place to start building a unified, companywide customer success strategy.

Gainsight CS was created with the best practices we’ve talked about thus far in mind:

Feedback: Gainsight CS combines visual journey orchestration with powerful automation to trigger personalized outreach at scale, drive higher response rates, and capture more insightful feedback.

- Scale customer feedback programs by building end-to-end workflows in Journey Orchestrator.

- Create high quality, personalized outreaches with native survey builder and email capabilities.

- Execute closed-loop processes by triggering the right type of follow-up, either human or automated, depending on the specifics of the response.

- Collect and understand both qualitative (raw text replies, manual meeting notes, call transcripts) or quantitative (NPS, CSAT, etc.) feedback.

- Listen to indirect (3rd-party sources like G2 and Salesforce) and behavioral signals (usage data, adoption, support tickets through built-in connectors).

Workflows: With Gainsight CS’s cross-functional Playbooks, your team can quickly close the loop with customers to drive improvements in customer satisfaction and retention, as well as take advantage of upsell and cross-sell opportunities.

- Follow up with detractors or turn positive experiences into positive reviews, advocacy, or new references with best-practice playbooks.

- Make life easy for your team with pre-populated email templates and playbook tasks.

- Set goals on follow-up actions and report out with portfolio-level reporting.

B2B CS vs. B2C CS

We’ve been talking explicitly throughout this guide about B2B, but the reality is there’s a lot of overlap between B2B and B2C CS in theory and practice. But there are also some key differences, and we’ve built Gainsight CS specifically to address those variables in a way that’s pretty unique in the marketplace. Here’s an example we can all relate to that crystalizes both the difference between B2B and B2C CS as well as where Gainsight CS has a an advantage over B2C point solutions.

Let’s say you have a pretty negative experience boarding a flight. It’s delayed, you’re mistreated or stereotyped, they downgraded you or moved your seat. You can tweet the airline, who can understand and triage your complaint, credit you with a bunch of frequent flier miles, and tweet or dm back to you what they’ve done—and this could all happen before the flight takes off! And that’s scalable through technology for simple problems at an individual level.

But CS challenges in B2B are almost never as simple as one person experiencing bad service on an individual case-by-case basis. In B2B, you’ll be getting multiple signals through disparate channels that point to a complex root cause that requires cross-functional coordination to solve. Gainsight CS is unique among CS and CX solutions in that it’s purpose-built to understand and diagnose the root cause of account-level CS issues and run cross-functional playbooks to solve them.

Insights: Powerful reporting capabilities let you identify trends in your business, optimize feedback programs, and prioritize strategic investments.

- Report out on a wide-range of survey metrics including NPS, CSAT, Customer Effort Score, and more

- Leverage customer health scorecards to turn raw feedback into customer health.

- Use sentiment analysis to understand what drives promoters and detractors.

See Gainsight in Action!

-

Products

Platform

-

Solutions

- Healthcare

- Education

- Security

- Customer Success Teams

- Product Experience Teams

- Product Adoption

- Gainsight Essentials

Industries and Teams

-

Resources

-

Gainsight

© 2024 Gainsight, The Customer Success Company. All rights reserved. // 350 Bay Street, Suite 100, San Francisco, CA 94133 // +1 (888) 623-8562

Terms and Conditions // Privacy // Do not sell my personal information // Security