The DAU/MAU Ratio: Tutorial & Examples

For most products, encouraging repeat usage and improving retention is critical to both user and revenue growth. Understanding product stickiness and how to measure it can help you drive higher retention and engagement.

A sticky product is one with which users are engaging and deriving value on a recurring basis. For some products, that may mean using it daily, while for others, it could be weekly or even monthly, but the key is the recurrence.

In this article, you’ll learn about the most commonly used stickiness metric: the DAU/MAU ratio. We’ll discuss how to analyze it, how to improve it, and when to use alternative metrics that may suit your business better.

Summary of key concepts related to the DAU/MAU ratio

These are the key concepts that this article will cover.

| DAU, WAU, MAU, QAU | Daily, weekly, monthly, and quarterly active users. These are measures of how many people use a product in different time periods. |

| Product stickiness | A representation of how often a user returns to and engages with a product. |

| DAU/MAU ratio | A common measure of product stickiness, calculated by dividing DAU by MAU and expressing the result as a percentage. |

| Usage pattern | The natural cadence with which someone uses a product. |

| Power users | Users with the highest engagement and usage frequency. |

What is the DAU/MAU ratio and why is it important?

The DAU/MAU ratio is a widely used measure of stickiness. It’s a metric that aims to answer the question: To what extent are users returning to use the product? This ratio is an easy way to understand whether users are getting enough value from your product to use it repeatedly.

Understanding this point is critical because user retention and engagement is fundamental to building a long-lasting, sustainable business. It costs 3-6 times more to acquire a new user than it does to retain an existing one.

The higher your DAU/MAU percentage, the “stickier” your product. To give an extreme example, imagine that you have 100 monthly active users and 90 daily active users. Your DAU/MAU, in this case, is 90%, meaning 90% of your monthly active users are using the product on a given day. If your ratio is that high over time, it means that almost all your users are using your product every day.

What is a good DAU/MAU value?

One great advantage of the DAU/MAU metric is that you can compare it across businesses regardless of the sizes of their user bases. However, you need to be careful to compare similar products. Different types of products naturally have different usage patterns, and what’s considered a good DAU/MAU benchmark for one might be unrealistic for another.

On one end of the scale, you have social media apps, which are used with high frequency and can be incredibly sticky. Facebook famously has a DAU/MAU ratio over 50%. At the other end of the spectrum, products in the ecommerce category attain an average stickiness of 9.8%, while finance products sit at 10.5%. The average DAU/MAU for SaaS products is 13%. Focusing specifically on B2B SaaS products, an acceptable benchmark (ignoring weekends and holidays) is approximately 40%. Meaning that, on average, a user is active eight out of twenty workdays in a month.

Even within product types, there may be differences. A SaaS product like Slack, which is designed for work communication, would naturally be used more frequently than a signature tool like DocuSign, so it makes sense for Slack to aim for a higher DAU/MAU target.

Some basic strategies for increasing the metric

Increasing DAU/MAU can be quite challenging because products tend to have a natural usage pattern or cadence. It’s unrealistic to expect to increase a ratio of 10% to 50% for a product without drastically changing its underlying utility and value proposition. However, there are some strategies that you can employ to optimize the number.

Improve activation rate and decrease time to value

Taking a step back to focus on activating your users when they are new—the time when they first perceive the value of your product—can improve new user retention and lead to some of the biggest gains in the DAU/MAU ratio. This is because the first step in getting users to come back to your product is ensuring that they experience its core value. Your activation metric should capture the moment when a user understands your product’s value, which usually involves tracking a critical action performed early in the user journey.

In addition to maximizing your activation rate, reducing the time it takes for users to experience value—time to value—will help you drive feature adoption. The more a user engages with your core value features or modules, the stickier they become.

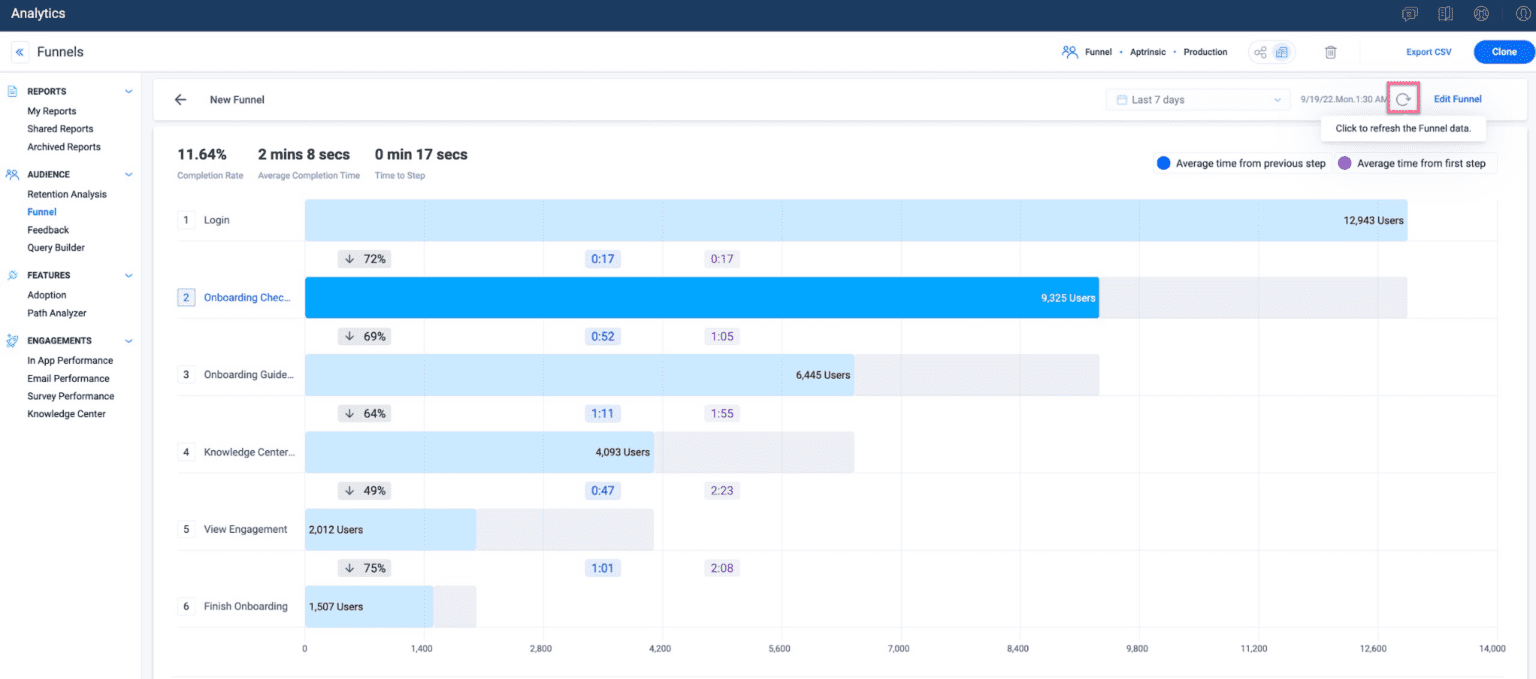

Analysis of your new user funnel will help you identify the steps where most users are getting stuck on their way to activation and help you design initiatives to minimize friction. These might include in-product checklists and walkthroughs to help users get started. Alternatively, you can target users who are stuck in a particular step of the funnel with highly tailored communications. These communications could be a combination of automated emails and push notifications that educate users on how to get the most of the product or 1:1 outreach from your sales and success teams.

Analysis of new user funnel (source)

Learn from power users

An important thing to remember when trying to improve any metric is that the aggregate often doesn’t paint the full picture. There are all sorts of hidden insights in the aggregate that you can discover through segmentation.

Try breaking down the metric by different user attributes, demographics, and types of device information. The goal is to uncover one or more segments of users where the DAU/MAU ratio is relatively high compared to the aggregate. These are the power users who come back and engage with your product most frequently. Once you’ve identified these segments, you can do a deep dive to understand who they are and how they derive value from your product.

Further quantitative analysis will help you understand what these users do, but you’ll likely need to complement this with qualitative techniques such as in-product surveys to collect user sentiment, or 1:1 interviews to understand why they behave the way they do.

Perhaps there is a use case these users found for your product that you hadn’t even thought of—you could educate other users about this use case. Or perhaps this segment lines up with a particular demographic, and you can adjust your acquisition strategy accordingly to onboard more of these users. By understanding your power users inside out, you can determine how to grow this segment and increase the aggregate DAU/MAU ratio.

Use communications mindfully

Sending email, push notifications, and alerts is a common tactic to make a product stickier. These work best when they are closely linked to the value that users derive from the product. A chat or messaging app relies on these notifications to bring users back to the app when they have unread messages from others. A B2B SaaS product might deliver daily or weekly email reports to help users get the most out of the tool. Regardless of the type of product, it’s important to ensure that the communications provide value to the user, as overuse of push messaging can backfire. The TRUSt framework—timely, relevant, useful, and straightforward—is a great checklist to use when crafting communications.

While communications that are sporadic and less personalized can succeed in bringing users back to your product, they are not the most effective way to increase the DAU/MAU ratio. A generic reminder saying “we haven’t seen you in a while” may spark enough curiosity to bring users back to your product on that particular day, but it is less likely to change their usage patterns. That means this tactic can actually have the opposite effect on DAU/MAU ratio, because it brings back casual users, increasing MAU more than DAU.

Just like you aim to deliver value with your core product, your alerts, emails, and push notifications should do the same.

Shortcomings of the DAU/MAU metric

Metrics can have some drawbacks, so they should be chosen carefully to ensure that they reflect the objectives and reality of the product. Here are some areas where the DAU/MAU ratio falls short.

It is a slow metric

Because of its dependence on the MAU figure, which looks back at the last month of users, DAU/MAU is inherently lagging. This means any movement won’t be noticeable immediately. While it’s still useful to look at the long-term trend, it may not be suitable for measuring the impact of product initiatives in the short term.

To measure the impact of changes, you ideally want a metric that gives you faster feedback. A B2B SaaS product whose developer updates its user onboarding process could look at the rate of activation of new users, time to first value, and the one-week retention rate. The key would be to look at how these metrics are changing over time. For example, you can look at the percentage of new users who return to the product after one week and compare cohorts of users to see if it’s higher for newer cohorts who experienced the new onboarding process.

For B2B products with a typical Monday-to-Friday usage pattern, looking at DAU/WAU may be useful to complement the analysis. The denominator here is the last seven days of active users, so the lag is much shorter than DAU/MAU, providing a shorter feedback loop.

It is not well-suited to low-frequency products

What if your product is simply not intended to be used with high frequency?666666

There are plenty of high-value, successful products that fit into this category. For example, many financial tools that are used to process invoices and payments may not require daily or even weekly use. In these cases, looking at the ratio of WAU/MAU or even MAU/QAU may be more helpful. These metrics work in the same way as DAU/MAU but use a longer time perspective.

For products with a low-frequency usage pattern, DAU/MAU is unlikely to change, and you can’t learn much from a metric that doesn’t move. Make sure to pick a ratio that’s most appropriate for your product.

It is not well-suited to situations where usage is driven by necessity

Another category of products that shouldn’t focus too much on the DAU/MAU ratio are those where usage is driven by a necessity that is unpredictable and sporadic in nature.

Talent marketplaces can often fall into this category. Businesses looking to hire contractors might be long-term users of platforms like Upwork or Fiverr, but their usage may be sporadic and entirely based on when they need to fill talent shortages for specific projects.

Another interesting example is Linkedin. Some users may visit the platform regularly if they are using it to generate sales leads or for recruiting purposes, but for others, the main benefit is that it facilitates job-seeking. Those users may only return to Linkedin once every few years when they’re looking for a new role.

Finally, many ecommerce businesses can expect sporadic usage if they are selling products that people don’t buy often, like furniture or electronics.

If your product fits into one of these categories, you likely have a very low DAU/MAU ratio. This is fine, because your business model doesn’t depend on frequent usage. In these cases, it’s okay to ignore DAU/MAU and focus on other metrics.

Conclusion

For products that depend on repeat usage to drive core business outcomes such as user and revenue growth, measuring stickiness goes hand in hand with understanding user retention and engagement. The DAU/MAU ratio is a great way to benchmark your product against others in similar categories. If your product has a daily or weekly usage pattern, you can use the DAU/MAU metric to track the long-term trend of your product’s stickiness in response to major initiatives and changes. Make sure to complement this with other metrics that give you faster feedback, so you can learn quickly and iterate.

If your product is used infrequently, you should consider using a different stickiness ratio, such as WAU/MAU. Finally, if your product has an unpredictable usage pattern or your business doesn’t depend on recurrence at all, it’s okay to favor other metrics over the DAU/MAU ratio. The most important thing is to prioritize metrics that help you track your progress toward your business objectives for the unique circumstances of your product.