This post was co-authored by Jay Nathan.

COVID-19 or not COVID-19, I bet you have heard that question many times, as it is one of the most common topics posed in #CustomerSuccess forums, conferences, blogs, and management meetings. There is also a striking commonality in the responses to the question. In essence, the argued position is usually either a ‘Yes’ or a ‘No’: clear, decisive, and primarily supported by one’s conviction, with minimal objective information supporting the position.

Not only is determining the ownership of ongoing customer revenue critically important, but it is also involved. Each company likely has their preferred solution. Therefore, executives and decision-makers could benefit from utilizing an analysis framework rather than personal anecdotes and preferences to make these decisions.

Generally, there are three options to manage the commercials of existing customers:

- ALL SALES: Sales Execs lead all commercial activity, while CSMs engage in non-commercial activities (mainly: driving outcomes, usage, and advocacy).

- UPSELLS vs. RENEWALS SPLIT: Sales Execs lead all new revenue activities (including upsells and cross-sells), while CSMs lead the management of existing commercial engagements, (i.e., renewals) alongside the non-commercial work.

- ALL CSM: Sales Execs drive sales to “new” customers only, while CSMs manage all commercial activities with existing customers (including both renewals and upsells/cross-sells).

Each option has pros and cons; thus leaders in the organization (heads of CS and Sales, as well as the CEO and CFO) will need to align their actions (job descriptions, compensation structures, hiring profiles, skill training, operating procedures and touchpoints between the teams, etc.) with the chosen strategy. I have seen a multitude of companies operating in each of the above options, signaling that they are all workable options from an operational perspective. But, how should the executives make the decision that best serves the company?

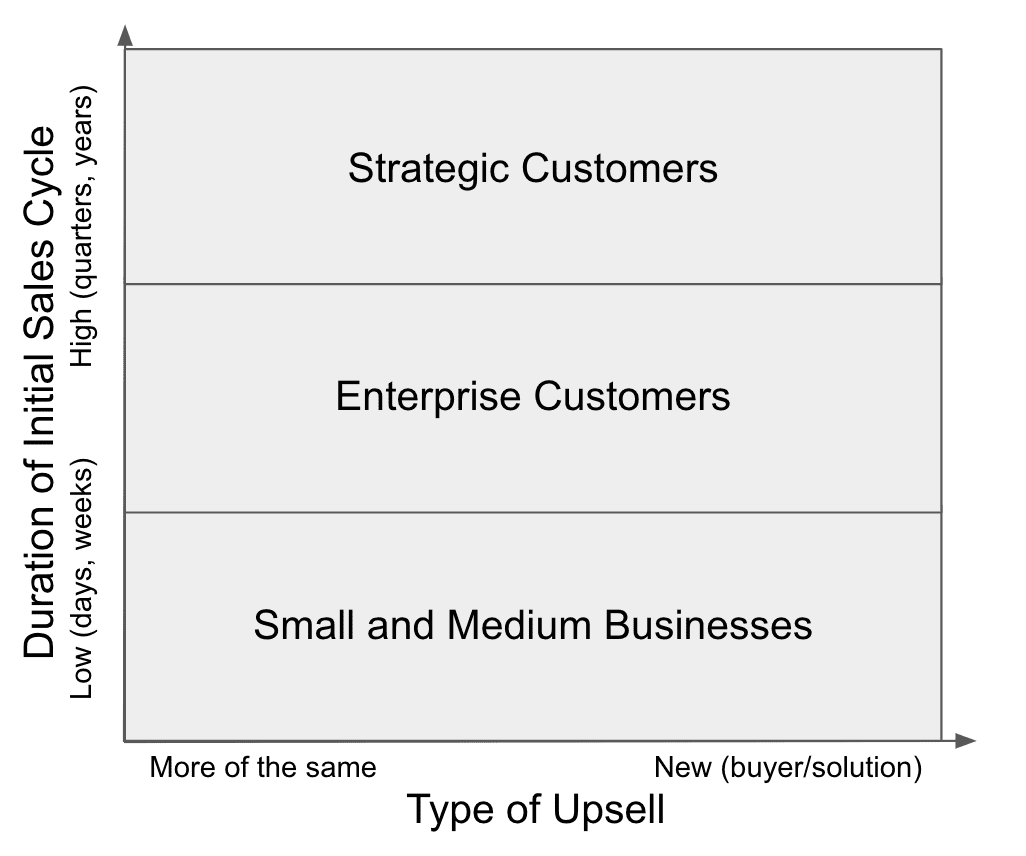

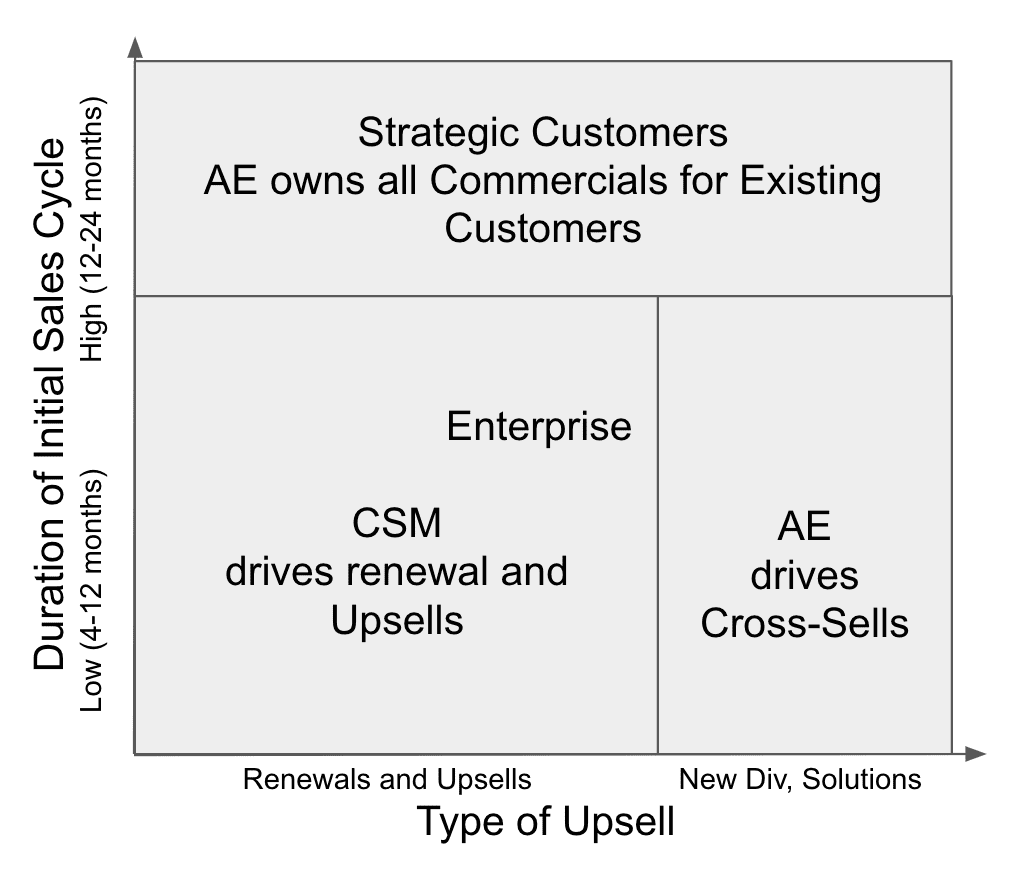

In my experience, there are ONLY two (2) primary vectors that should influence this decision:

- The Length of the Sale Cycle

- The Type of the Upsell

The Length of the Sales Cycle:

Typically, longer sales cycles require a more substantial investment in time, energy/effort, and cost for the Sales Executive to build the relationships needed to win the initial deal. The most straightforward measure of this is the average duration of the sales cycle. But, it can also be measured by the cost of it (CAC), which for many high-performing companies, is highly correlated to the sales cycle duration.

The larger the initial time and cost, the less it makes sense to transfer those relationships to a different person (CSM), and the more it makes sense to maintain the ownership of the relationships with the Sales Executive. It is worth noting that the length of the sales cycle closely correlates with the size of the organization the company is selling to (target market) and to the expected revenue (ASP) from them. More significant deals can justify longer sales cycles, and smaller deals can only be viable if their sales cycles are short.

This point is easiest to understand when you think of extreme situations. Think of companies that sell to Telecom, Auto, or Aerospace companies. In each of these markets, there are only a few hundred, sometimes dozens of potential customers worldwide. The people in charge of selling to them own the relationships with a small set of those companies, sometimes only one or two, regardless of whether they are already a customer or still a prospect.

On the other extreme are companies selling directly to consumers (B2C) or small customers (SMB). In many of those situations, there are no dedicated salespeople at all, as the size of the deals can not justify them.

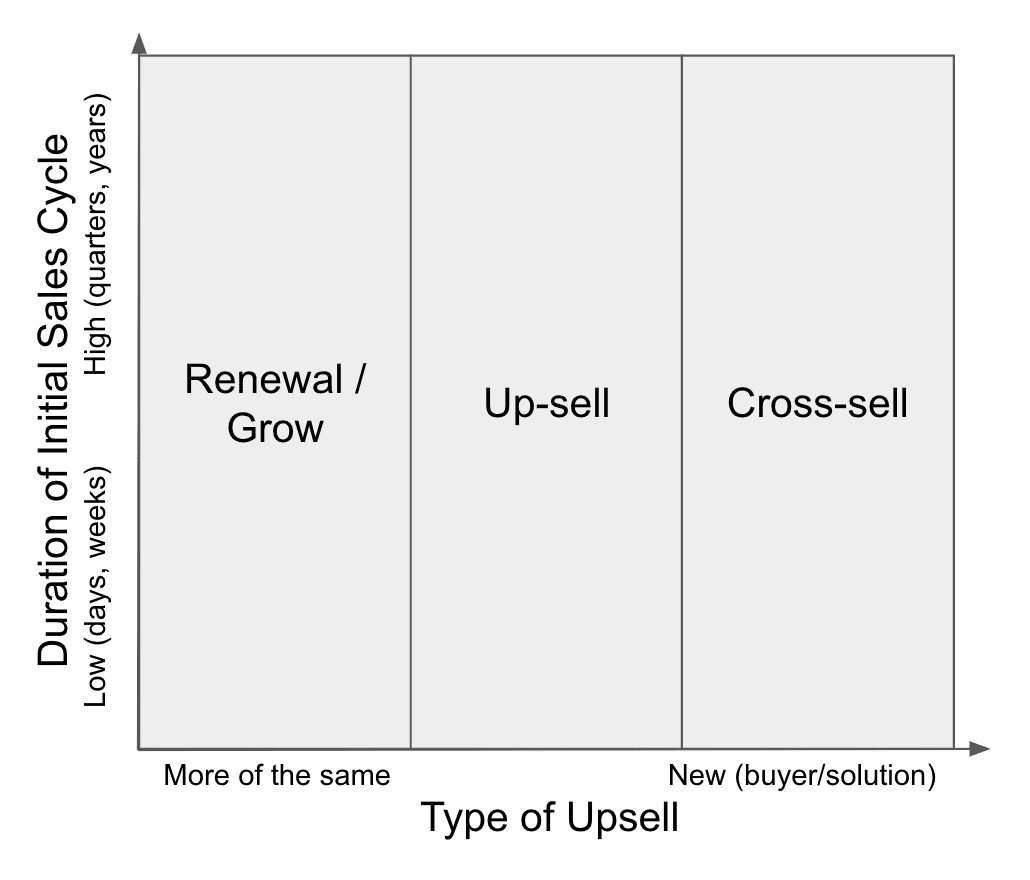

The Type of Upsells:

Assuming there is upside potential from the customer (or the “account”), it is essential to identify what drives that upsell. The drivers of revenue growth from customers can be:

- Price Increases

- Increase in Units of Consumption: more minutes, more data, more reports, more transactions, etc.

- Increase in the Number of Users: Wherever the pricing relates to the number of people using the solution. Two subcategories here:

- Organic: Growth in the number of people using the solution due to the growth of the company or teams using your solution. This needs to be tracked but not heavily influenced by the vendor. Example: The company grows and hires more salespeople, all of whom require access (and therefore pay extra) to Salesforce.

- Proactive: This is usually the result of an active bulk expansions selling to new divisions or business units, or applying to a new use case).

- New Solutions: Here too, there are nuances: sometimes, the expansion is for new features (a premium version or additional individual elements), while other times, it is an entirely new solution.

The more the upsells come from “more of the same” (increased pricing, higher consumption, organic growth, expansion of features, etc.), the more it makes sense for the person who manages the ongoing working relationship with the customer (the CSM) to drive those upsells. The more the upsells come from NEW sales – new products, new divisions – the more sales work is needed, and the more it makes sense for the salesperson, not the CSM to own this task.

Taking these two vectors together should enable any company to devise a strategy that optimizes for its business. The chart here provides an example of how to put this together into an analysis for a particular company.

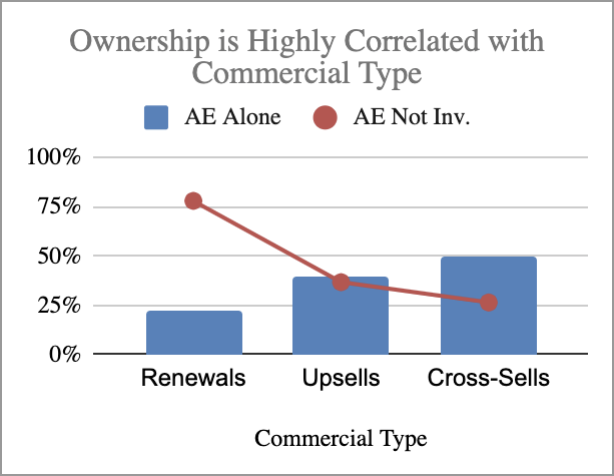

Data from a survey conducted in 2019 by Gainsight supports this notion, as can be seen in the charts below. First, there is a clear correlation between the type of commercial activity (illustrated in this dataset as Renewal, Upsells, and Cross-sells) and the ownership of it by the original salesperson (aka AE) or a new team member who manages the commercial ownership of the relationship. This latter one is sometimes referred to as Account Manager (AM) and sometimes Customer Success Manager (CSM).

Correlation between the type of commercial activity and ownership is seen in two ways; first, by examining the portion of companies where the salesperson is solely responsible for commercial activity. The second is where the salesperson is collaborating with others (AM and/or CSM) in that effort. The blue bars indicate that the portion of companies where the salesperson (AE) is solely responsible for the commercial relationship increases from 22% to 40% to 57% when the type changes from Renewal to Upsell to Cross-sell. Further, illustrated by the red line, the portion of companies where the AE is completely hands-off (AE Not Involved) in the commercial decision decreases from 78% in Renewals to 37% in Upsells to 26% in Cross-sells. The above stats are the average across all companies regardless of size and industry.

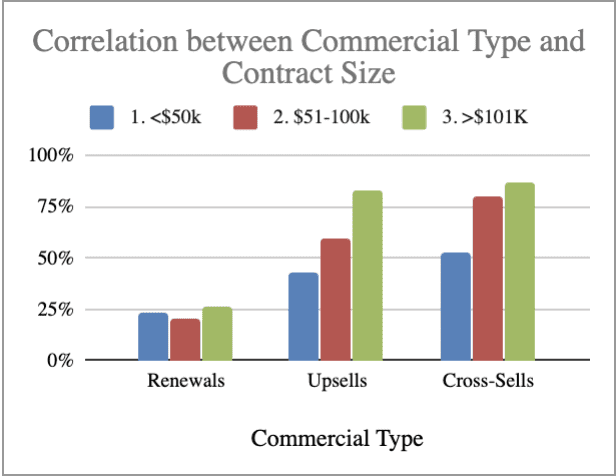

Assessing the correlation between the Contract Size (ASP) and the ownership can be seen on the graph here. The figure shows the portion of companies where the salesperson is involved/leading the commercial activity with customers.

- No correlation within renewals: 20-25% of companies entrust the original salesperson with the responsibility for renewal regardless of contract size.

- High correlation for Upsells: from 43% of companies that entrust their salesperson to lead the upsells within smaller contracts (<$50K) to 63% in midsize contracts ($51-100k), to 83% for very high ASP (>$101K).

- High correlations for Cross-Sells: same trend as with Upsells with portions of companies entrusting salespeople with ownership of that work moving from 52% among small contract sizes to 80% at midsize to 87% at large contracts.

What do customers want?

Aligning the org structure as well as the roles and responsibilities of the people to the customer’s needs and wants, makes a lot of sense. Customers want to maximize value from the solutions they acquired from a vendor, which requires generating the most value at the lowest possible cost. This optimization suggests speed and ease of working relations. But, that can be achieved in different ways and is more dependent on clear internal roles & responsibilities and external communications with the customer than on org structure.

For example, most customers would not want different people to manage their renewal and upsell contracts, but rather a single person. However, a salesperson or a CSM can accomplish this depending on how the R&R is defined. Another example: Customers want a dependable person they can contact if they have a problem, one that has the knowledge, authority, and attitude to own and solve it: a “single throat to choke.” Again – fair, but does that necessarily mean AE or CSM?

Final Note: Culture Eats Strategy Every Day

The above is a suggested framework that can help organizations thoughtfully strategize this pervasive problem. But, like all frameworks, it can help define the options and clarify their implications, not make the decision for you. Organizational design decisions should take into account other factors such as the company’s culture, the brand image it wants to portray to the outside world, and the skills and interests of the critical people already in the org. Those non-quantifiable aspects are often the ones that swing the decision.

Since this is a “hot topic” among the Customer Success community, we would very much like to solicit your feedback on it. Please comment on the blog to add your perspective.

Finally, there are several more questions we would like to answer, such as:

- How does the size of the customer factor into commercial responsibilities?

- How does the size of the SaaS company impact commercial responsibilities?

- How does the Customer Success organization fit into the overall organizational structure?

If you are willing/interested in supporting us going deeper into this topic, please complete the attached short survey (it should not take more than 5 min of your time).