This post was co-authored by Nick “Walt” Walker.

Whenever people ask me what my favorite TV show was as a kid, I pause to decide whether to reveal my secret shame or not.

While I loved cartoons and still remember the theme song to “The Golden Girls,” what I was addicted to at ten years old was CNBC. I loved hearing the anchors’ over-the-top voices and feeling the drama of the bulls and bears fighting it out.

Thank goodness I got over that phase because watching CNBC as an adult isn’t always fun. The last few months, in particular, for technology stocks have been a bit less relaxing than watching Betty White (may she rest in peace) hang out with her friends from back in the day.

But even though the stock market may be on an uncertain trajectory, it turns out one of the key metrics driving valuations in SaaS stocks remains the same: Net Revenue Retention (NRR).

What Is NRR?

A little refresher in case you are new here. Net Revenue Retention or NRR is a metric that measures how much your existing customers are growing. You take the total recurring revenue for a set of clients at the end of a period (e.g., a year) and divide it by the same recurring revenue for those clients at the beginning of the period.

Whether it’s more users or additional features, it considers the amount a given company’s customer base is growing. If you had ten customers and one churned, but the other nine doubled their spending, then the NRR would be 180%.

Who Owns NRR?

NRR has been the primary focus of the Sales and Customer Success teams for years. The Sales team goes out and gets you new customers and hopefully expands your current customers. The Customer Success team ensures that those customers are receiving their desired outcomes and getting value from your product. And then when the renewal is due, either Sales or Customer Success (depending on who owns the renewal cycle and how your org is structured) secure that renewal, upsell, and cross-sell opportunity.

However, it’s no secret that other teams like Product, Marketing, Support, and your entire company should also own NRR. Marketing drives NRR through communicating customer value, finding advocates, and enhancing engagement. Product drives NRR by delivering and solving customer pain points and challenges. Ultimately, your entire company needs to own NRR.

Latane Conant, CMO at 6sense, wrote a blog about how Marketing teams should be obsessed over NRR. In addition to customer acquisition, teams need to be driving customer marketing with customer programs such as networking and user groups, creating use cases to drive adoption in areas that some customers might know of, and helping CSMs engage with key decision-makers to make sure they are aware of those programs and use cases.

How Does NRR Affect Valuation?

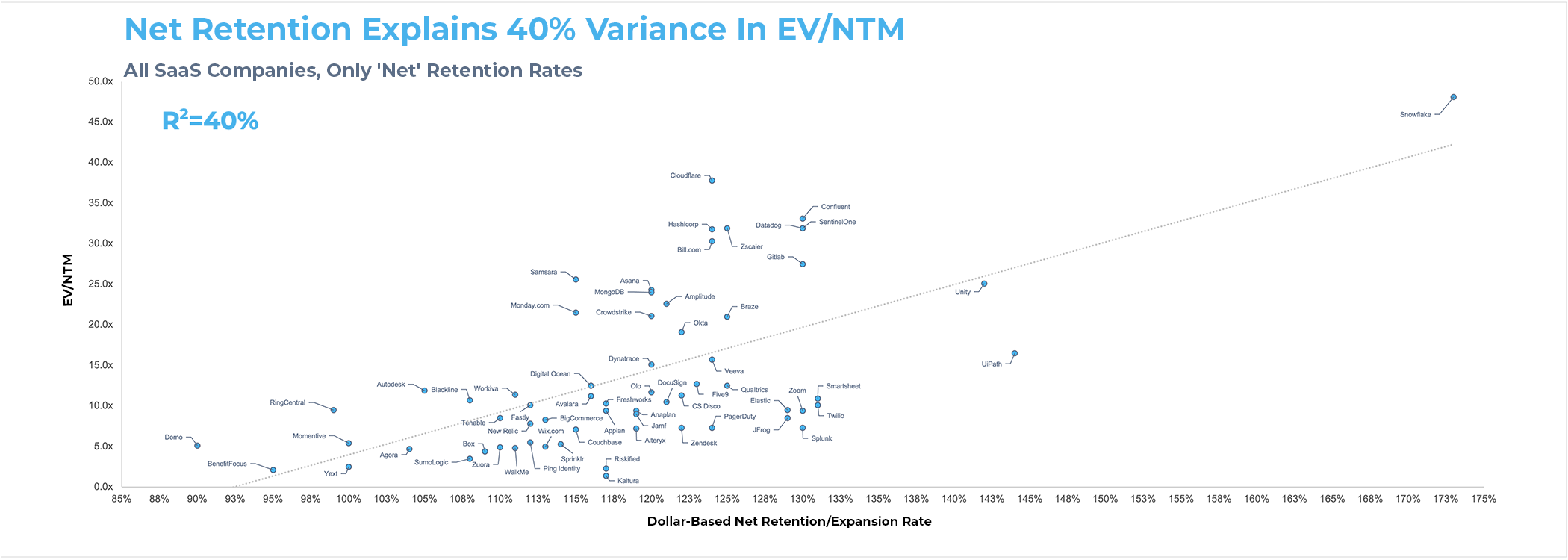

We analyzed the data from Clouded Judgement that reports Net Retention metrics to understand their relationship with revenue multiples* (EV / NTM Revenue).

The results below indicate a clear positive relationship between a company’s NRR and EV / NTM Revenue ratio. The regression coefficient of 0.63% suggests that each percentage point increase in NRR is associated with a ~0.63x change in a company’s revenue multiple.

This relationship appears throughout the dataset. For example, the companies in the top half of the NRR distribution show an average EV / Revenue multiple of ~21x, while those in the bottom half show only ~10x.

Conclusion

NRR is the next stepping stone in the growth of companies. And NRR isn’t just owned by one team – it’s the entire company from Sales to Customer Success to Marketing to Product. A few years ago, you would have been hard-pressed to find those three letters in the annual reports of publicly traded SaaS companies. Now, you find that ~70% of public cloud companies are adding in their NRR rates to their SEC filings.

NRR is here, and Wall Street is taking notice. That is good news for us, especially if you’re stuck still trying to figure out how much your dividends will payout.

Notes

*EV / NTM multiple data was pulled from Clouded Judgement on Jan 28, 2022; Net retention data is based on the latest company filings as of Jan 31, 2022, using data listed either as net retention rate or net dollar expansion rate.