March 2020. Feels like decades ago, huh? We were learning to work from home, optimizing our Zoom backgrounds, and buckling in for “a few weeks” of quarantine. Little did we know.

And from a SaaS leadership perspective, in March, we wondered what will the year look like financially? Truth be told, we are all still wondering, but the image is coming into greater focus.

In mid-March, we sent out a survey to the CXOs of public and late-stage private SaaS companies asking about their expectations for customer retention. We received an incredibly high response rate, signaling the importance of this topic.

We know a lot has changed in two months, so we decided to re-survey the same base and review how they are thinking about their clients and retention in the coming months.

Here’s what we learned:

1. Churn Rates Are Going Up But Not As Much As People Thought

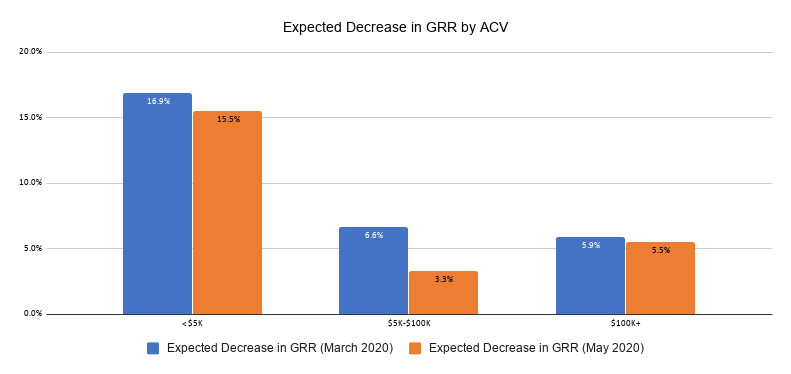

Although respondents initially thought their Gross Renewal Rates (GRR) would decrease by 3-6% in enterprise segments and 17+% in SMB segments, all respondents now predict slightly less churn than they initially thought. We observe that most companies have by now triaged their installed base and quantified the COVID-19 risk. In addition, we anecdotally hear that the majority of incremental churn due to COVID-19 is not full churn (e.g., customers canceling) but is instead downsells and downgrades (e.g., fewer seats, lower prices, fewer modules, etc.)

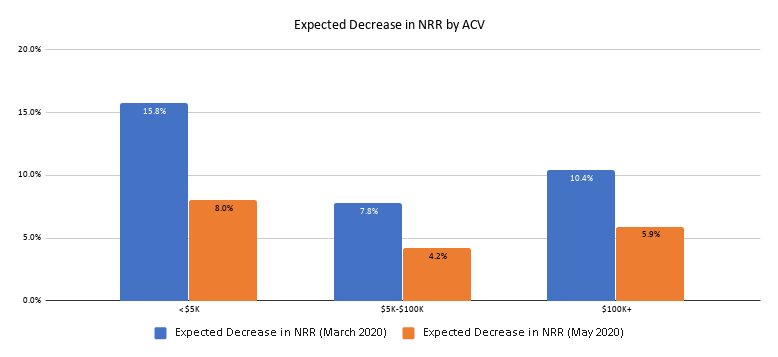

2. Net Retention Rates Are Also Getting Worse – But Not As Bad As People Thought

We were not surprised when our March survey indicated that most SaaS businesses expected up-sell / cross-sell to decline versus plan, but luckily businesses or all sizes think the decrease will be much less than they originally thought.

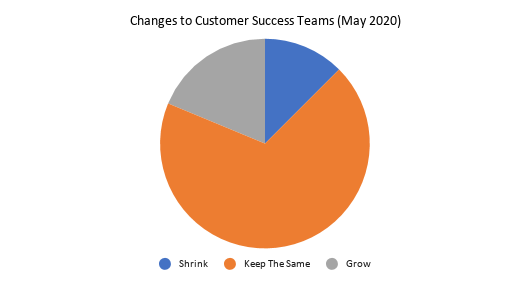

3. Companies Are Keeping Or Growing CS Teams

The vast majority of companies (87.5%) plan to keep or grow their CSM teams during these challenging times, demonstrating the importance of retention.

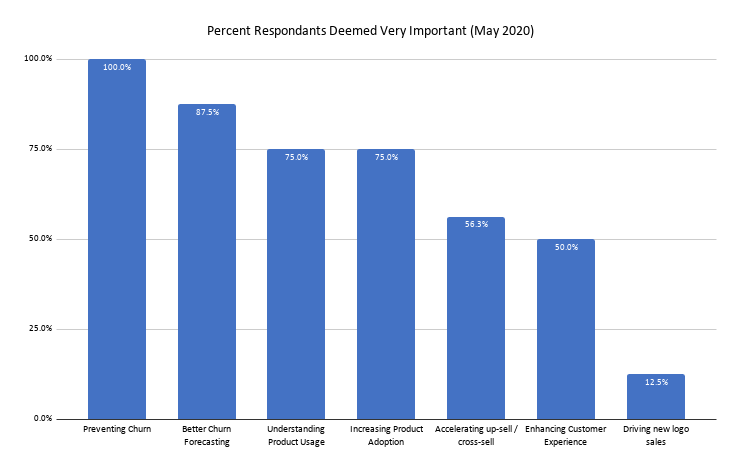

4. Churn and Product Are Top Focuses for Companies

We asked participants to rate various initiatives as “very important,” “somewhat important,” or “not important.” 100% of companies ranked preventing churn as “very important.” Other important focuses included churn forecasting, understanding product usage, and increasing product adoption.

5. Top Actions Taken During COVID-19

Many companies took the same approaches we recommended to Minimize Churn Through A Downturn. Our respondents indicated focusing on:

- Risk management processes

- Better retention forecasting

- Health scoring

- Long-term renewals in exchange for concessions

- 1-to-many Customer Success

- Redesigned onboarding

- Success planning

- Automation to help CSMs

In short, in the words of one respondent, “we’re finally doing the things we should have always done.”

6. Next Challenge in Customer Success During the Downturn

Given the continued focus on Customer Success and preventing churn, we also asked respondents about the challenges they are facing right now. Many respondents are focused on showing value and outcomes, which they know will help prevent downsell. Many also noted they believe mid-market businesses are more impacted than enterprise companies.

- Value and outcomes

- “Amplifying value.”

- “We need to do a better job documenting business outcomes. We have created a task force to attack this across all renewals greater than $100K to start with.”

- Reducing downsells

- “We believe that Q3 and Q4 will have the most pressure for downsell as budgets are reset based on COVID-19 FY21 revenue impact. With increased customer focus on budgets, the results have been smaller (10-20k) downsells that add up quickly.”

We hope this data helps us all plan better for the future.