How many years ago was January 1, 2020? I don’t know about you, but I lose track of time these days.

Even though winter is officially over, like Ned Stark from Game Of Thrones, it seems like we’re all preparing for darker days ahead.

January 1st might have been the start of your fiscal year. You might have been reared up to ramp new sales. You might have been en-route to your Sales Kickoff. A lot has changed. Given the downturn, companies are doubling down on the “recurring” part of Annual Recurring Revenue. They’re trying to make sure they preserve their clients through the recession. What we learned is that’s not going to be a slam dunk for all companies.

We surveyed CEOs, CROs, and CCOs of late stage private cloud companies (e.g., Forbes Cloud 100) and publicly-traded SaaS companies (e.g., BVP NASDAQ Emerging Cloud Index). These companies generally represent the “best of the best” of what the cloud offers. So, to some extent, they are a bellwether for technology.

Here’s what we learned:

1. Retention is of high interest right now

The first learning came from the survey responses themselves. We emailed a population of 82 respondents and received 41 surveys back. If you aren’t in the market research business, a survey response rate (without an incentive like a gift card) of 50% is almost unheard of. The fact that busy people took time to respond means that this is topical.

2. Churn rates are going to go up significantly in SaaS

Of our respondents, 77.5% believed their anticipated Net Retention Rate (with the benefit of upsell) would decrease by at least 3% and up to 20+%. Of those companies, 40% believed it would reduce by 11% or more.

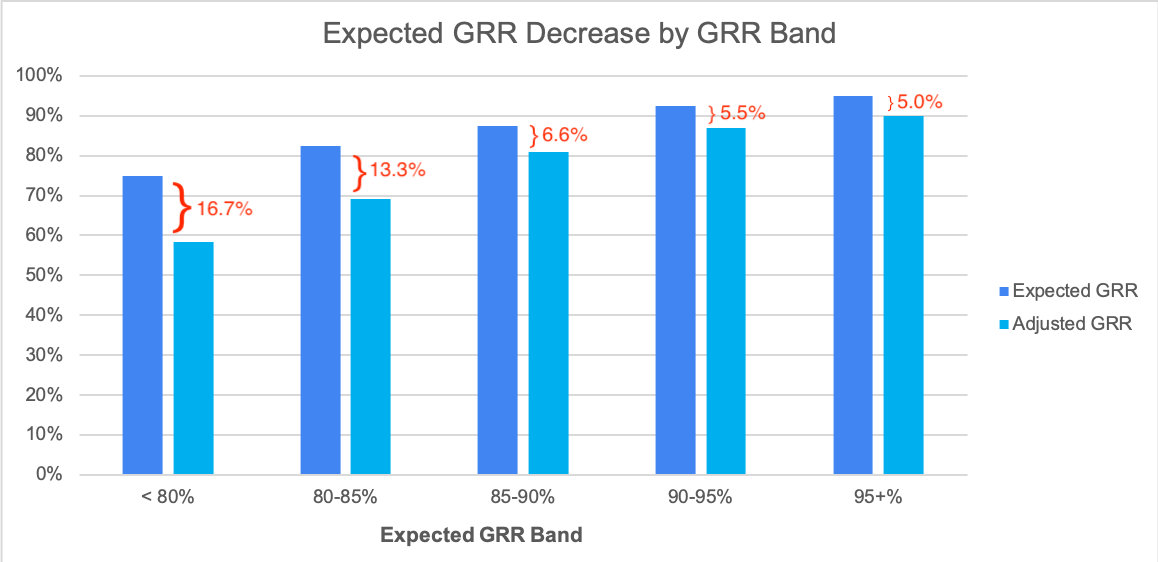

3. Churn rates will go up for companies with high and low retention rates, though more for low retention firms

Since we also queried the company’s current Gross Retention Rate (GRR) pre-COVID19, we were able to graph the expected decrease in retention versus prior GRR. The headline is that the companies that are “stickier” (high GRR) tend to expect small drops in GRR.

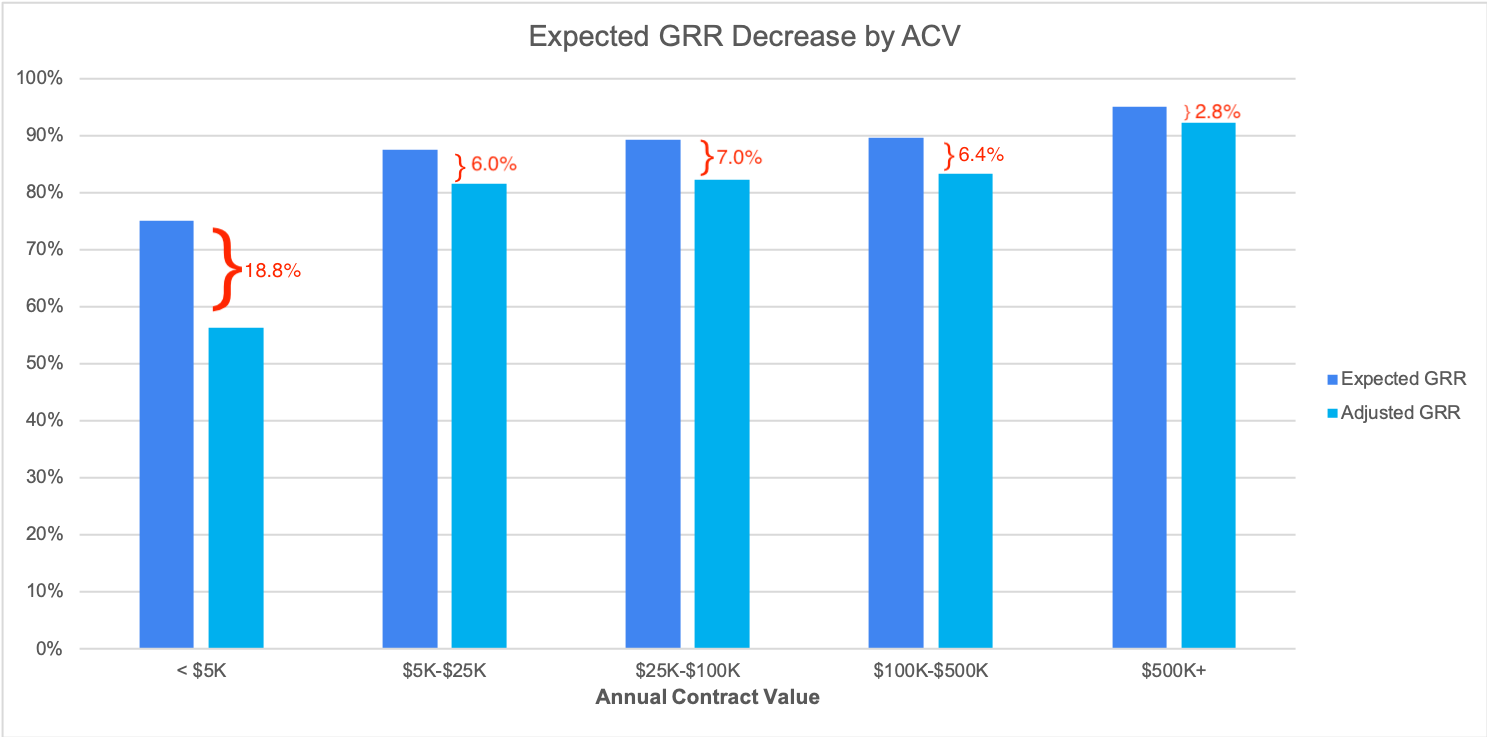

4. Churn rates will go up the most for companies selling to SMBs

We asked respondents what their Average Contract Value (ACV) was. We then compared the change in Gross Retention Rate to ACV. Probably very related to question #3 above, companies with small contracts expected the greatest increase in churn.

5. A material part of churn increases will come from down-sells

As companies shrink their businesses and staff, they will need less software from their vendors. Many respondents see this trend in their businesses:

“There may be many instances where we do not see full customer churn but significant contraction in licenses.”

“We expect broad based down-sells – Customers will take a closer look at capacity and eliminate forward demand”

6. Huge spikes in churn are likely due to vertically-oriented businesses

A minority of firms (12.2%) project a 20+ percentage point increase in churn. This type of change is usually due to a massive wave of bankruptcy, shutdowns, or layoffs in a specific industry or set of industries. Companies with vertically-concentrated businesses in adversely-affected sectors expect significant struggles.

To quote one respondent:

“The biggest weakness is our customer environments. We are seeing customers who use our tool getting laid off in entire groups which removes the need for our technology. We also have a number of customers in hard hit industries like airlines and hospitality.”

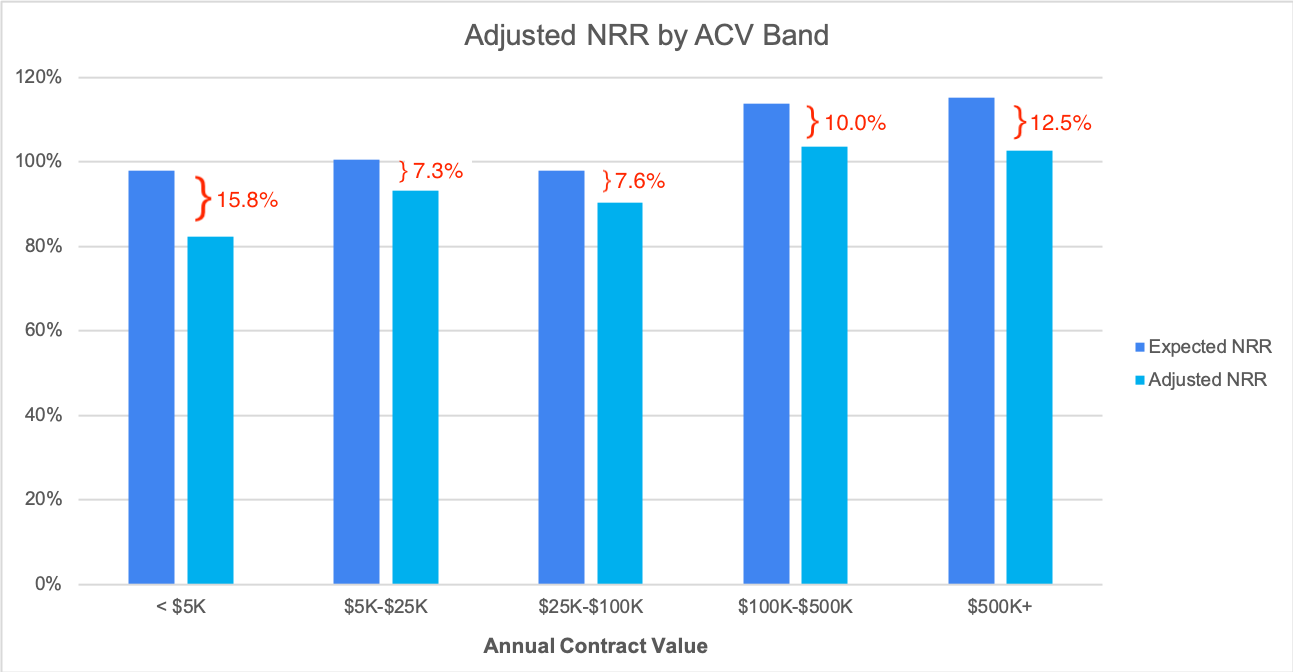

7. Expansion and Net Retention Rates will also decline

Not surprisingly, in an economy where very few firms are hiring or growing, most SaaS businesses expect upsell/cross-sell to decline versus plan, and therefore to see more Net Retention Rate compression than they saw in Gross Retention Rate.

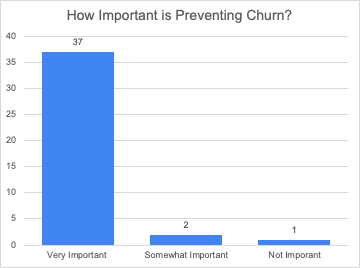

8. Preventing churn is existential

We asked participants to rate various initiatives as “very important,” “somewhat important,” or “not important.” 37 out of 41 firms rated preventing churn as “very important.”

This is particularly exacerbated since most companies expect massive slowdowns in “new logo” sales. To quote one respondent:

“New logos will be the most challenging by far.”

Relatedly, 28 companies ranked accelerating cross-sell/upsell as very important, and 27 said the same for increasing product adoption.

9. Companies are wrestling handling concessions

Inevitably, some customers will face hard times and vendors aspire to help. The question is how much should they help, while still minding their own businesses:

“Hierarchy of needs: 1. Payment terms; 2. Short term discount; 3. Downgrade; 4. Cancel.”

“We’ve seen some businesses do very well as a result of the pandemic. Others have struggled. Some are going to completely go out of business. One of the big challenges is filtering out businesses that are asking for financial concessions because they are genuinely impacted by the crisis from companies using this event as a trigger to negotiate a better deal.”

10. Using internal health metrics and external customer industry health metrics, companies are re-forecasting

The crisis has naturally sorted companies into three categories:

- Category 1: Businesses in the ecosystems of in-person restaurants, hotels, airfare, energy, in-person retail, and the like might be challenged to buy or retain anything.

- Category 2: Companies not in Category 1 or 3—the messy middle.

- Category 3: Businesses in industries like healthcare, remote work, videoconferencing, logistics, e-commerce, delivery, etc. that will long-term benefit from the changes caused by the crisis.

As such, many companies are looking to implement data-driven forecasting to manage their risk:

“Would be interested in how others are thinking about, evaluating, quantifying the new risk brought on by Covid.”

11. Despite challenges financially, most businesses look to keep or grow their Customer Success Management teams

The vast majority of respondents have recognized the linkage between proactive Customer Success Management and renewal rates. As such, while many companies are considering staff cuts overall in other teams, 85% of those polled plan to maintain or grow their CSM team.

12. There is a playbook to get through this, but it requires CEO-level focus

As we’ve written many times, Customer Success is a company-wide strategy, not just a department. Never before has that been more true. As such, CEOs and CXOs need to work with their Customer Success teams to double down on their client base. We’ve written a playbook to get started here.

Conclusion

January 1st, 2020 seems like a long time ago. And the SaaS industry has a lot of work in front of it to get to January 1st, 20201 and beyond. The good news, as evidenced by the response to this survey, is there is an eagerness to work together and make sure we all survive and thrive. We’re excited to continue the knowledge sharing.

You can see some of that knowledge (much of it based on this data) in a webinar hosted by Gainsight and Byron Deeter from Bessemer Venture Partners —click here to get the details.