One of the best parts of the Customer Success community is the feeling that we are all in it together as CS evolves. No one is an expert, and everyone must adopt the philosophy of the Beginner’s Mind as we innovate and discover more about our field. Customer Success peers help each other out more than any other profession I’ve seen in tech. As such, we at Gainsight regularly survey the CS network to understand what we’re all learning together.

Given that Customer Success is still a “new-ish” organization, many leaders continue to wrestle with questions around organizational structure and ownership. In particular, we repeatedly hear three questions:

- Who owns each part of the customer lifecycle? (e.g., “Who owns the renewal?”)

- Are people charging for Customer Success?

- How are people structuring Customer Success in a multi-product environment?

In our most recent survey, we took away the following seven insights.

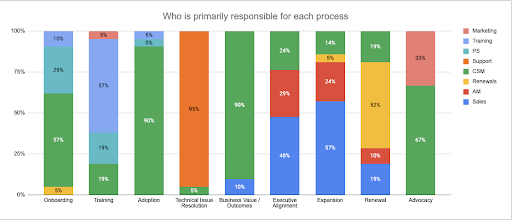

First, let’s look at how companies are dividing up ownership along the customer journey:

- CSM is the primary driver responsible for “Adoption” (90%) and “Business Outcomes/Value” (90%), but they are part of every moment of truth in some way.

That’s no surprise, but it’s good validation.

- Renewals Teams are becoming very prominent (52%), while Sales & AM represent only 29% of renewal ownership.

More and more companies are moving renewals away from Field Sales (except for big enterprise renewals) and into a dedicated Renewals team. Some take this further and give the CSM ownership of the entire renewal motion. This new direction tends to be true in businesses with lower Average Contract Values (ACVs).

- Executive Alignment is a shared responsibility across Sales/AM/CS, with Sales playing an essential role.

Customer Success teams are working hard to have stronger executive relationships. It is clearly still a work-in-progress as the industry up-skills the relationship capabilities of CSMs.

- Sales is the primary owner of expansion (57%). However, we increasingly see CS play a pivotal role in pipeline generation.

CSMs have unique insight into clients around expansion. They know “when” – when clients are ready for doing more (and when they are happy!) They know “what” – what problems they have and what products could solve them. They know “how” – how a Sales professional could position the value delivered to date and the potential value. And they know “who” – who the stakeholders are to get the deal done. Many companies are beginning to implement models to incentivize CSMs to be the “eyes and ears” for the Sales team for expansion.

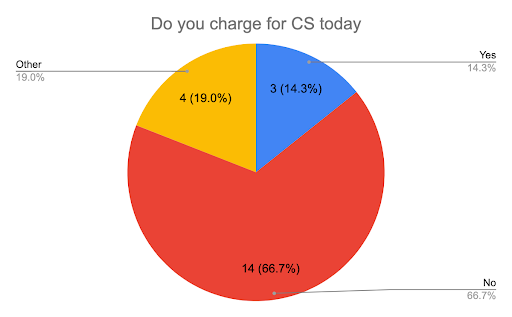

- 67% of respondents do not charge for CS.

As companies scale, one of the biggest challenges is how to fund Customer Success. Some companies justify spending by pointing to the Return on Investment vis-a-vis higher renewal rates or more expansion.

- The majority of respondents who charge for CS are traditional on-prem companies that have transitioned to SaaS.

Others, particularly larger and more mature businesses, fund part or all of Customer Success as a paid service. We believe the trend over time is for companies to have a mainstream “for free” CSM offering and a high-end “for fee” package.

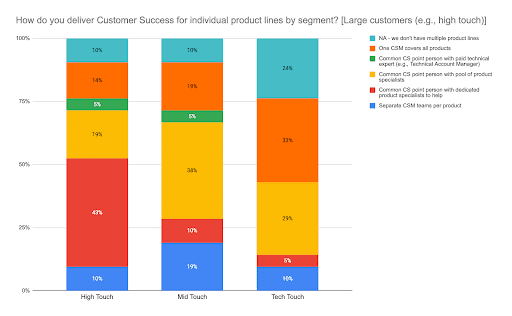

- Multi-product organizations frequently have a common CSM act as point person with product experts providing technical support.

As larger companies look at CS, the question is how can they have a customer-centric view across a broad product portfolio. There are a range of approaches, from (1) every product has a separate CSM team or (2) a primary CSM has to know everything. Increasingly, we are witnessing a model where CSMs take an account-oriented perspective while leveraging a pool of product-level specialists.

While the CS community continues to evolve and grow, we at Gainsight will be here to share knowledge with the CS community so we can progress forward-—together.