From the beginning, we’ve said that Customer Success is not just a department – it’s a company-wide priority. Over the years, we’ve discussed how CS needs to be intimately-connected to Sales, Product, Marketing, and other functions. We even wrote about how CEOs need to take more ownership of Customer Success.

But one voice hasn’t been prominent enough in the Customer Success dialogue – Finance. Finance is the heart of a company from a shareholder point of view, and Chief Financial Officers are the stewards of shareholders’ precious capital.

With COVID-19, companies are realizing more than ever that much of the capitalization of SaaS companies is tied up in their recurring revenue streams – and in their ability to keep customers. On a recent call with public company and private equity-backed CFOs, a prominent SaaS equity research analyst said “right now, the most important thing in SaaS is churn. Full stop.”

And CFOs certainly know this, since we are looking at which vendors to keep and which ones to “churn.”

Given this, CFOs are increasingly being pulled into conversations around customer success with their Chief Customer Officers, VPs of Customer Success, and other executives. The most proactive of us are asking these questions to their CS counterparts:

1. What’s our new retention forecast – and scenarios?

If your fiscal year started 1/1 or 2/1 like us, you might feel a little shortchanged. You just finished all of this extensive planning. And if you’re like us, you thought the plan was a thing of beauty. So many Excel files and tabs. All down the drain now.

The reality is that COVID-19 affects every business in the world – and more importantly, all of us as human beings. So every company needs to reforecast.

But forecast is probably the wrong word. Your company is likely thinking about various scenarios for the economic recovery – from the fast “V-Shaped” rebound to the long “U-Shaped” recession to the dreaded “L-Shaped” depression.

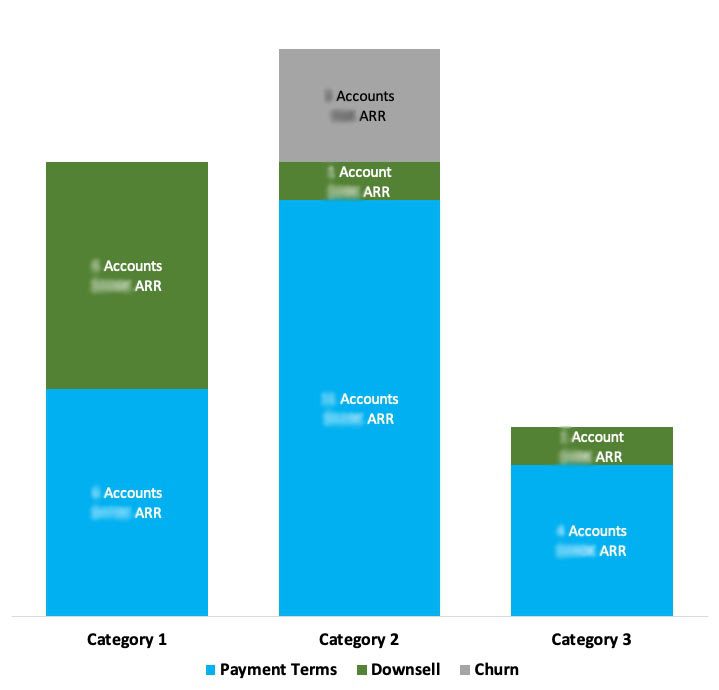

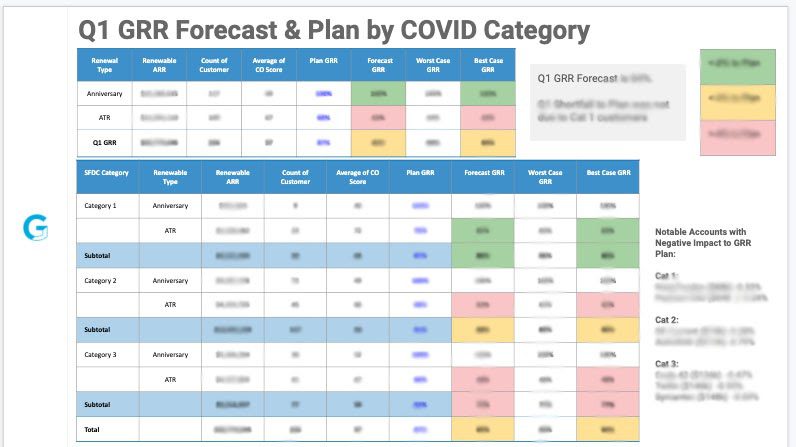

At Gainsight, we asked our CS team to build 3 scenario models. And we asked them to use as input the “impact” to each customer in question from COVID-19. We broke our clients into 3 buckets:

- Category 1 – Negatively-impacted (e.g., companies serving the hospitality space)

- Category 2 – Neutral to mild negative impact (e.g., horizontal companies selling to enterprises)

- Category 3 – Positively-impacted (e.g., telehealth companies)

We have always had a renewal forecast based upon health data (e.g., adoption), so we started there. Then we ratcheted down the renewal expectations for each scenario (V, U, L) based upon the category of each company. For example, Category 1 companies have a lower than expected renewal rate in all scenarios but it gets worse as you go from V to L.

You can read more about the process we used here.

2. How much of an impact are we seeing from concessions?

Now I wish the only challenge was renewals. If you’re like many businesses, your clients are asking for:

- Changes to payment terms (e.g., annual to quarterly)

- Delayed payments

- Pauses in contracts

- Reduction to contracts during the term of the agreement

I don’t want to get blindsided by this, so I asked our CS team to work with our team to build a process for tracking concessions. We can now see the total ARR impacted by each concession type. We meet on this weekly and review all new requests as a team.

3. What are our early indicators of churn that we’re seeing?

I know that the world is changing rapidly. Even in good times, we don’t want to get blindsided by churn (especially given that Gainsight can help reduce churn). But these aren’t good times, so the matter is more urgent.

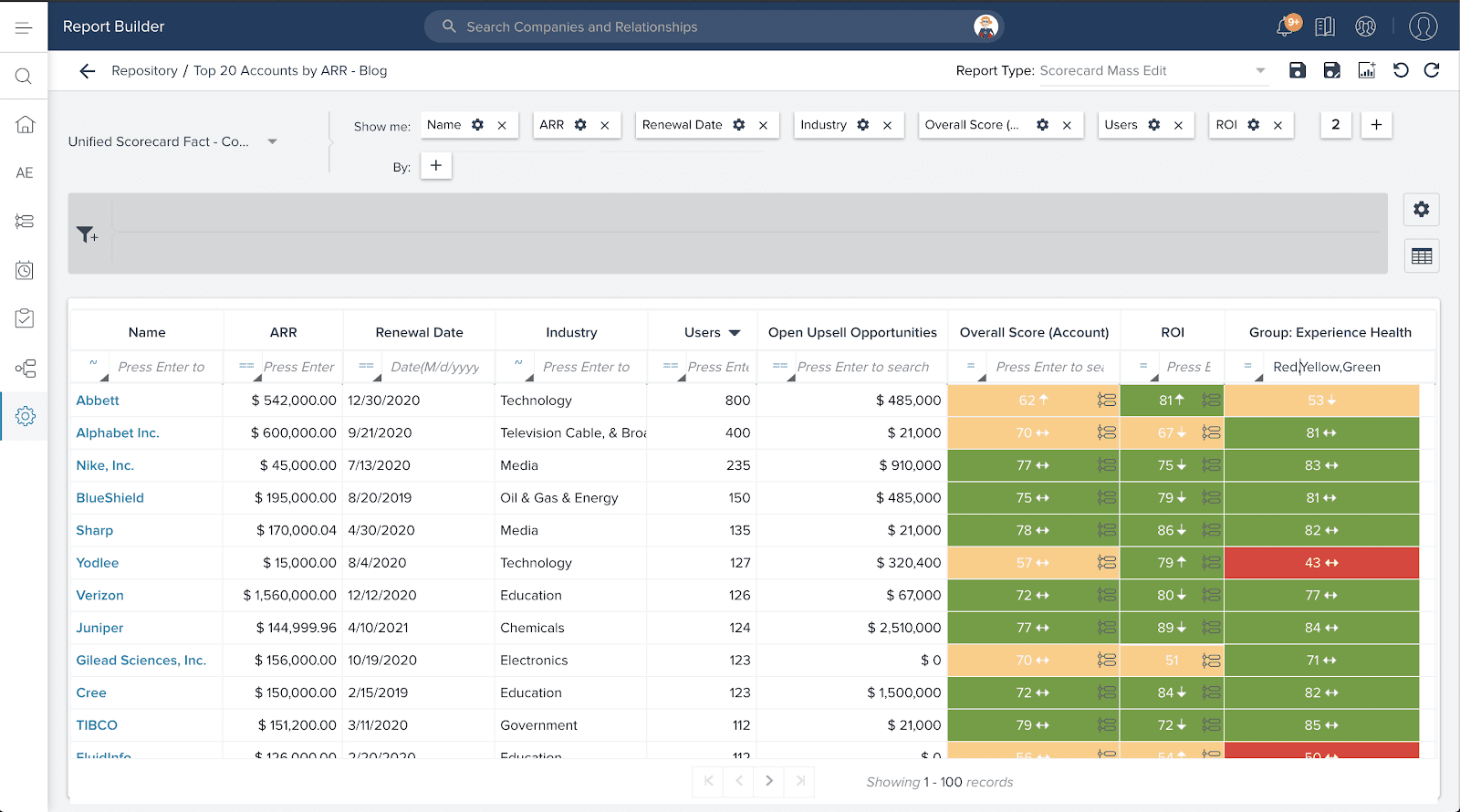

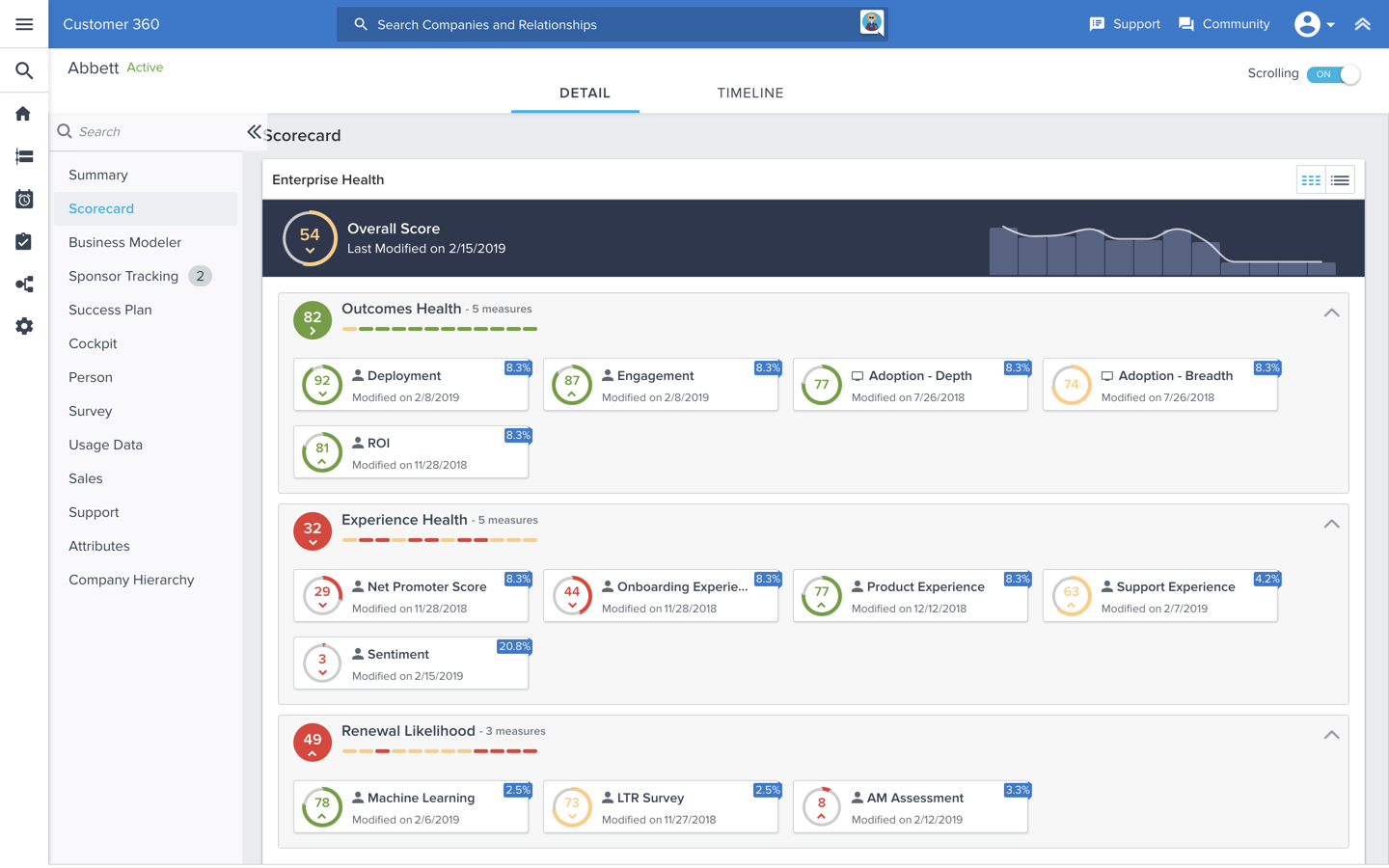

I asked our CS team to revisit the leading indicators they look at—like Deployment, Engagement, Adoption (both depth and breadth), and ROI. Do we need to up the frequency of our ExecutiveEngagement outreaches? What are we doing to reduce seat under deployment or underutilization? It seems like ROI confirmation is more important than ever to measure if we are driving verified outcomes.

4. What can we do to swarm our larger clients?

Like many businesses, our clients span the range from large to small. As such, a small number of clients have a disproportionate impact on our Gross Renewal Rate and cash flow. I challenged the CS team to gather more detail about our largest accounts, not only in terms of their overall health but also specifically their downgrade / downsell risk. This resulted in even more rigor around their weekly reporting, including a deep-dive into top accounts in every renewal forecast.

5. How can we do more with less?

I’m not easy on budgets. It’s my job to be a little tough. But in these tough times, that responsibility becomes paramount. We need to make sure we have the right expense structure and cash position for any-shaped economy.

As such, I’m asking the CS team how they can manage our growing portfolio of clients without hiring. How can they “do more with less”, through automated emails, pooled customer success, in-product communications, and the like?

The CFO’s job isn’t meant to be easy or to make people feel good. Like all of you, I feel a responsibility to make sure our company survives and thrives through anything that can come at us. Leaning into the insights I’ve gained from customer success has allowed me to do this more effectively than ever in the face of this downturn.