This post was co-authored by Ashvin Vaidyanathan.

Investor Gavin Baker wrote a terrific blog where he shared his thoughts about recurring revenue. In short, you can’t take it for granted that your recurring revenue will, in fact, recur.

5) There is no such thing as truly “recurring” revenue.

Some revenue is just more recurring than others.

— Gavin Baker (@GavinSBaker) March 20, 2020

Never is that more true than in a crisis or downturn. Most companies revert to zero-based budgeting and start with $0 in expenses and build back to anything they want to spend money on—whether “new” or a “renewal.” It’s a bitter pill to swallow, but your customers don’t give a hoot about your retention rate.

At the same time, during downturns—and particularly in crises—many companies shut down new projects altogether. They get very short-term oriented and pare all the way down to only activities that “keep the lights on.”

As such, most businesses during an economic dislocation rightly shift all of their energy to client retention. But for plenty of companies, that’s a 180 degree turn. So how can a management team navigate back from “Sell! Sell! Sell!” to clients and customer success?

In our experience, these 10 steps are the fundamental building blocks of preserving the first “R” in Annual Recurring Revenue.

1. Categorize Your Clients

Before you look inside, gaze outside. How are your clients affected by the crisis of the day? In the case of COVID-19, we propose the following categories:

- Category 1: Businesses in the ecosystems of in-person restaurants, hotels, airfare, energy, in-person retail, and the like might be challenged to buy or retain anything.

- Category 2: Companies not in Category 1 or 3—the messy middle!

- Category 3: Businesses in industries like healthcare, remote work, videoconferencing, logistics, e-commerce, delivery, etc. that will long-term benefit from the changes caused by the crisis.

Some decisions will be hard and require you to split traditional industries. Selling to educational tech companies? Some of your customers that focus on in-classroom learning might be struggling. But those that enable distance learning are in a boom.

Even if it takes brute force, it’s imperative that you understand the business climate surrounding your clients.

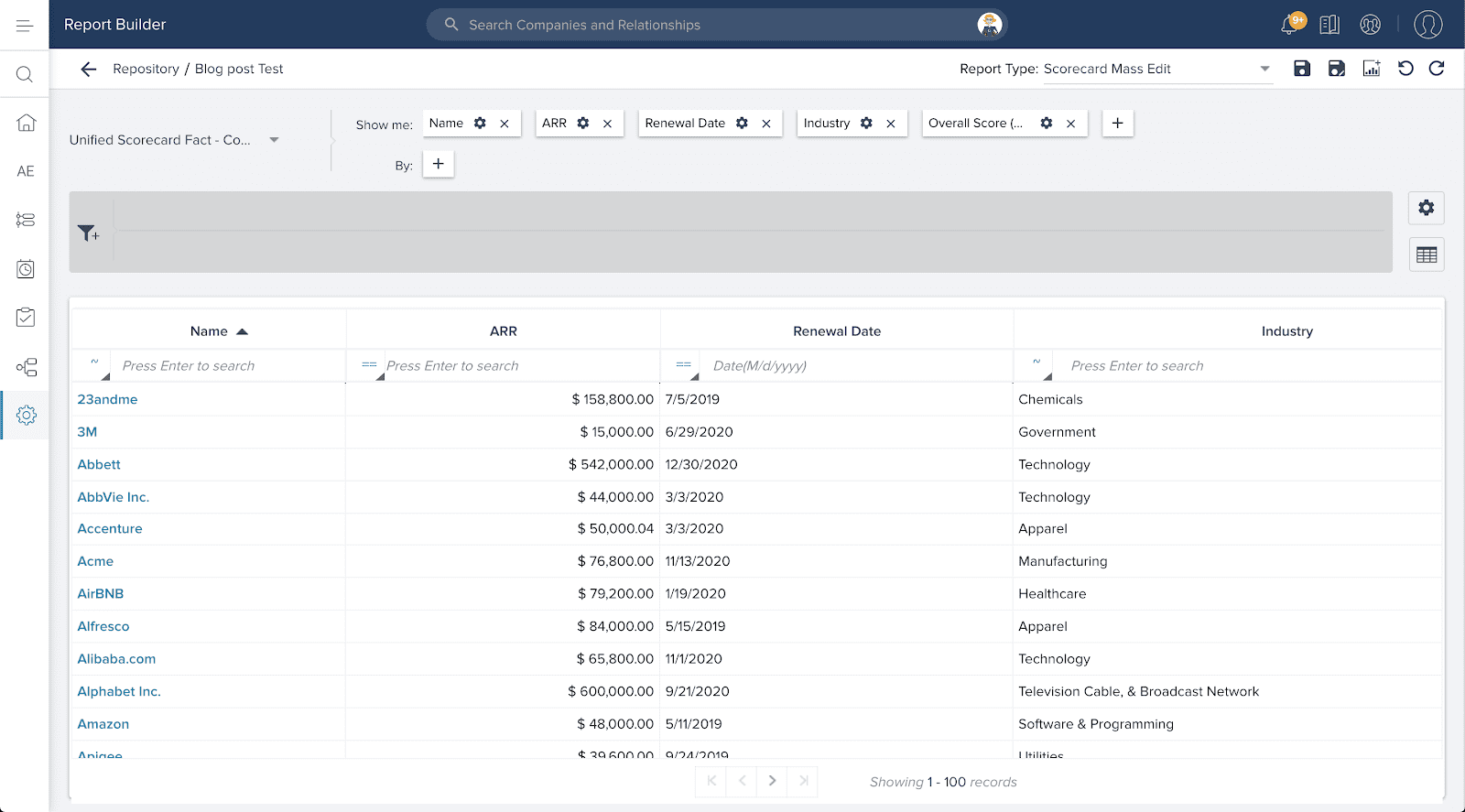

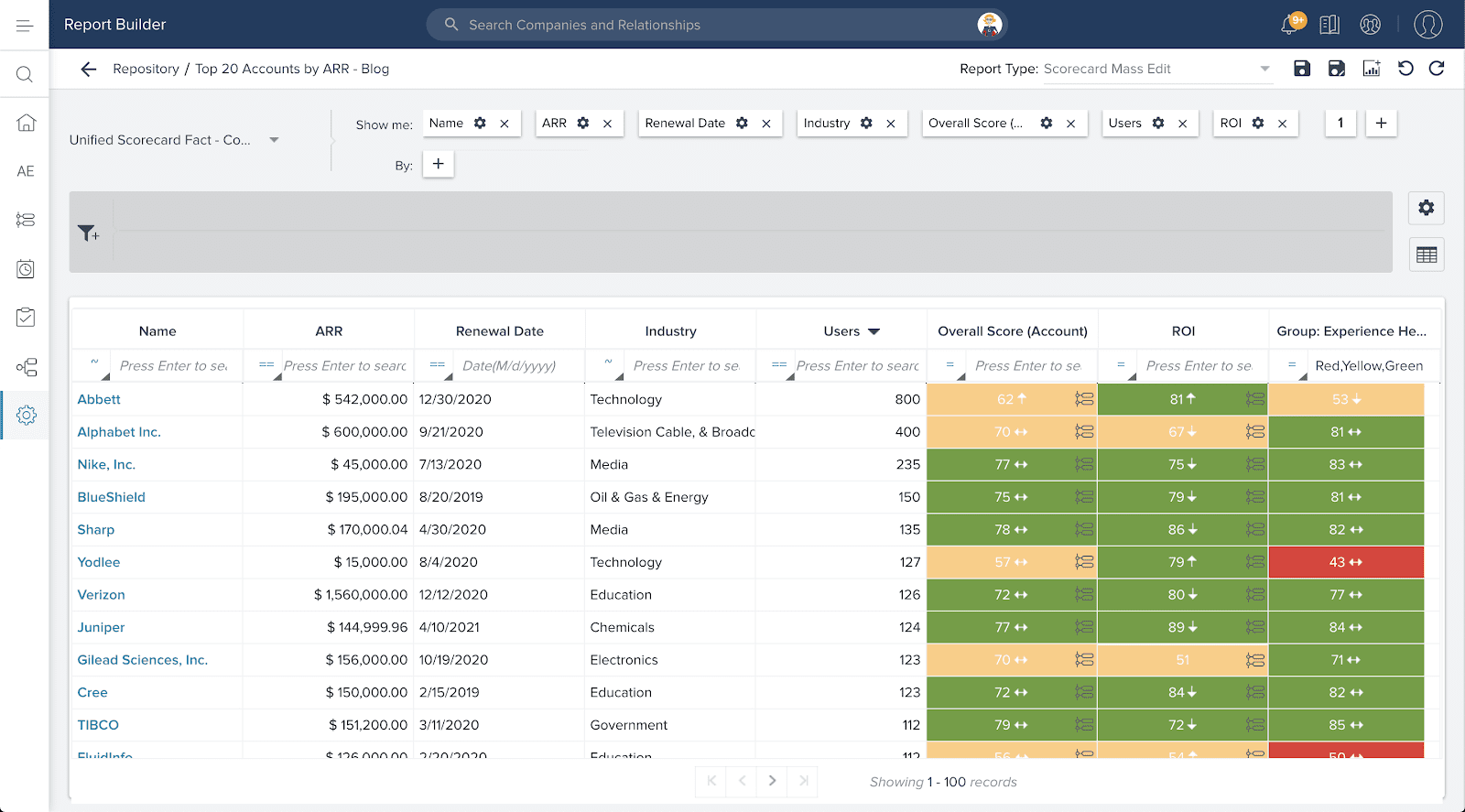

Conceptually, you should now have a table with four columns:

- Customer name

- Business category from the above

- Annual “Recurring” Revenue

- Renewal date

All data shown is sample data.

2. Understand Customer Usage

Usage in SaaS is necessary but not sufficient. If clients are using you, it doesn’t necessarily mean they are getting value. But if they aren’t using you, they probably are not achieving their goals.

In addition, underutilization is a direct cause of the silent churn known as down-sell (customers reducing their contracts). Finally, underutilization gives the procurement team at the client negotiating leverage. “We’ve been paying for this stuff we never used.”

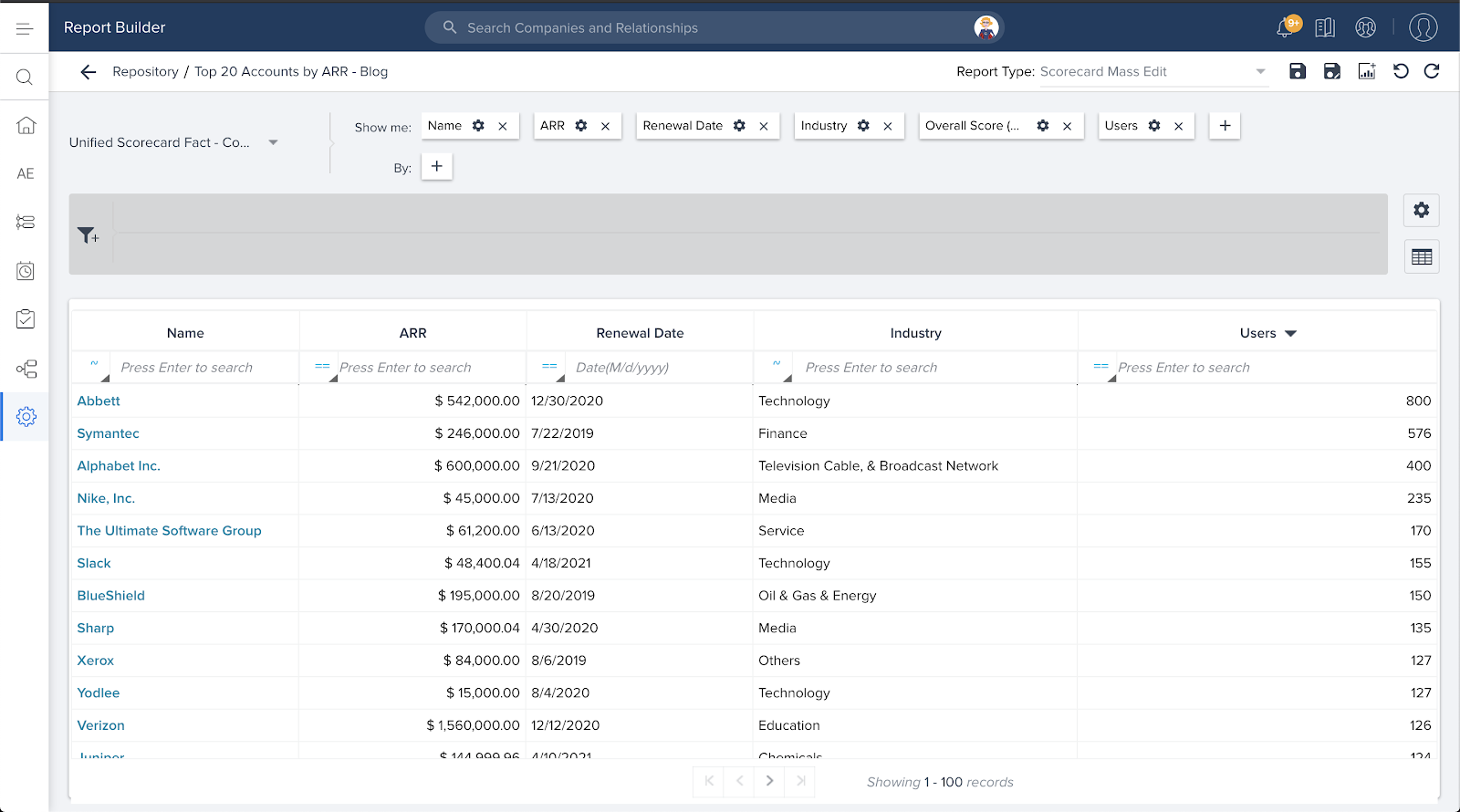

You hopefully have access to real-time product utilization data. Using this, you can produce a quick report to show your clients and their relative utilization.

All data shown is sample data.

And don’t stop there. Use the time you have left to increase usage of the product, through in-application guides and messages.

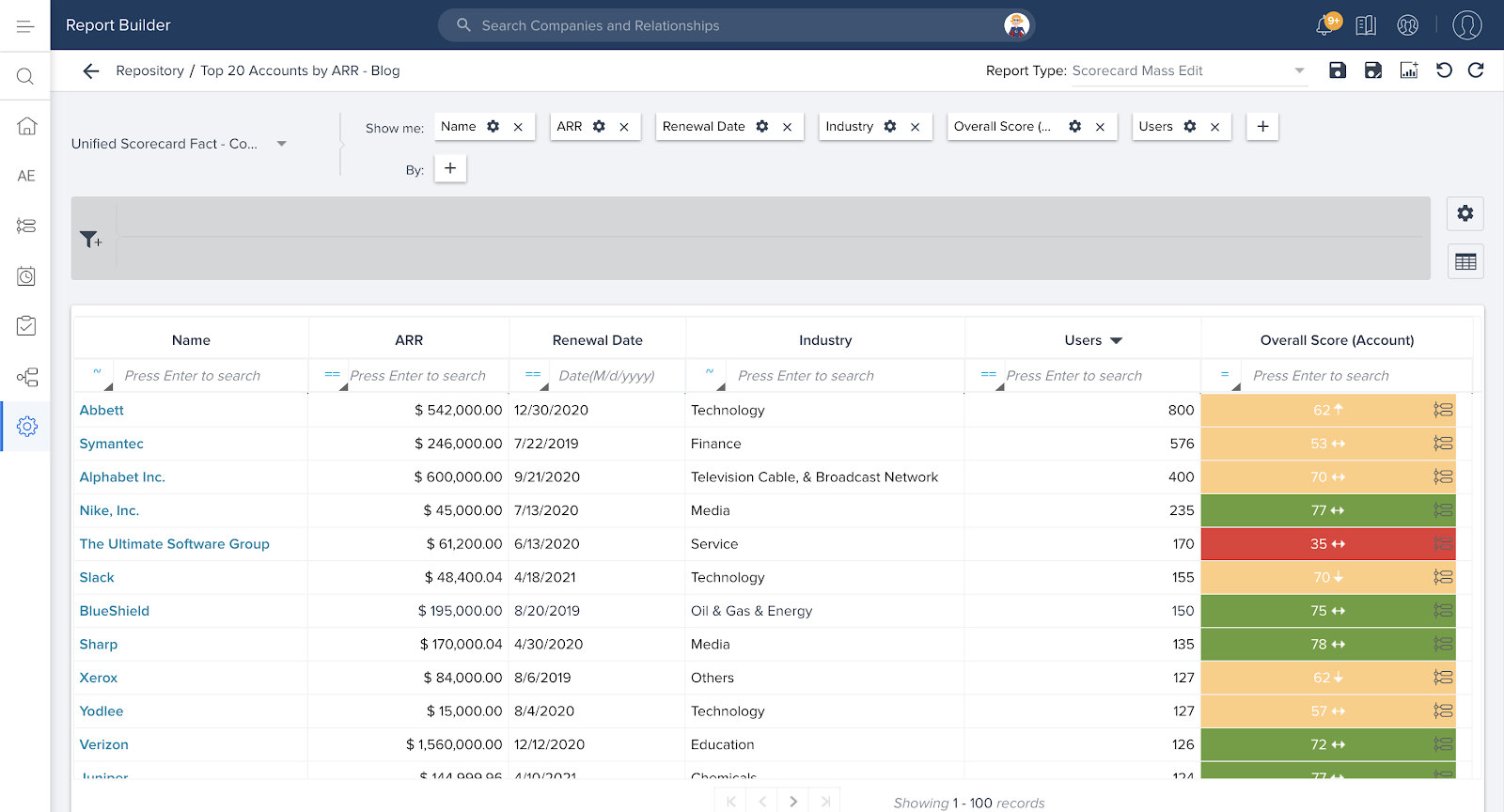

3. Assess Client Health

As we said above, usage is necessary, but not sufficient. Next, add in an overlay as to the health of the client. This could be via a sophisticated health score measuring factors like adoption/telemetry data, support ticket activity, implementation satisfaction, engagement, and the like. Or it could simply be the judgment of the CSM or Account Manager.

All data shown is sample data.

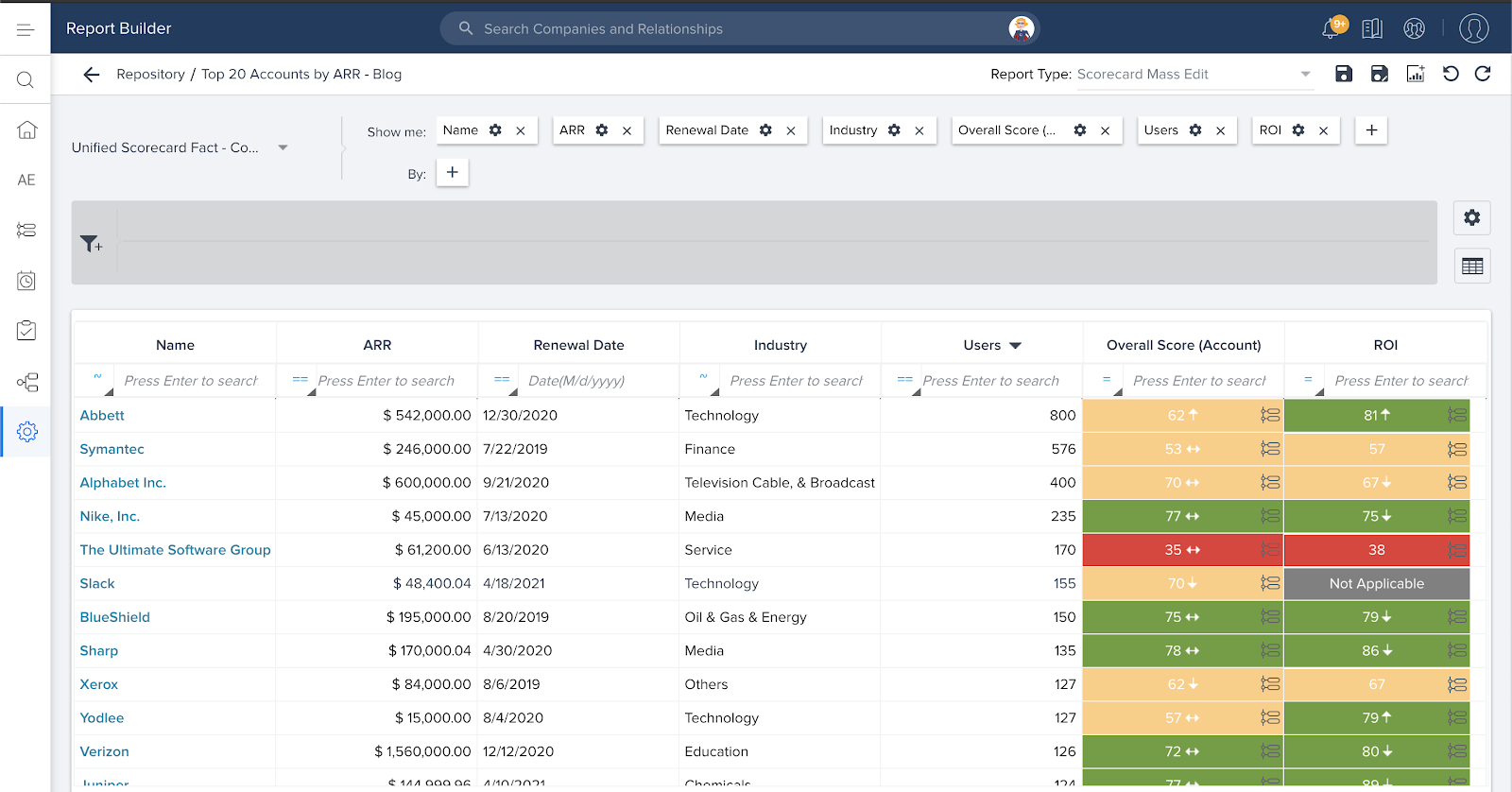

4. Define And Demonstrate Outcomes

The health is just your own point of view though. For your larger clients, you need to make sure you understand what their goals were too. Hopefully you’re tracking these in a Success Plan per client. But if not, it’s not too late. Use the current situation as a chance to reset with your customer. Try a message like, “I understand your goals have likely changed; can we quickly get aligned on how we can help?” Then make sure those goals are documented. And ideally, you have been tracking these goals all along and can show the Verified Outcomes your client has achieved.

All data shown is sample data.

5. Ensure Exceptional Customer Experience

Delivering outcomes is very important, but not sufficient on its own—especially in crisis times. The other half of the equation is making sure you have your focus on delivering exceptional customer experience. You could measure this based on surveys (Net Promoter Score or Customer Satisfaction), engagement with your events and teams, engagement at Advisory Boards, etc. Delivering both Outcomes and Experience sets you up on the path to not only shoring up the recurring revenue but also setting up an upsell/cross-sell conversation.

All data shown is sample data.

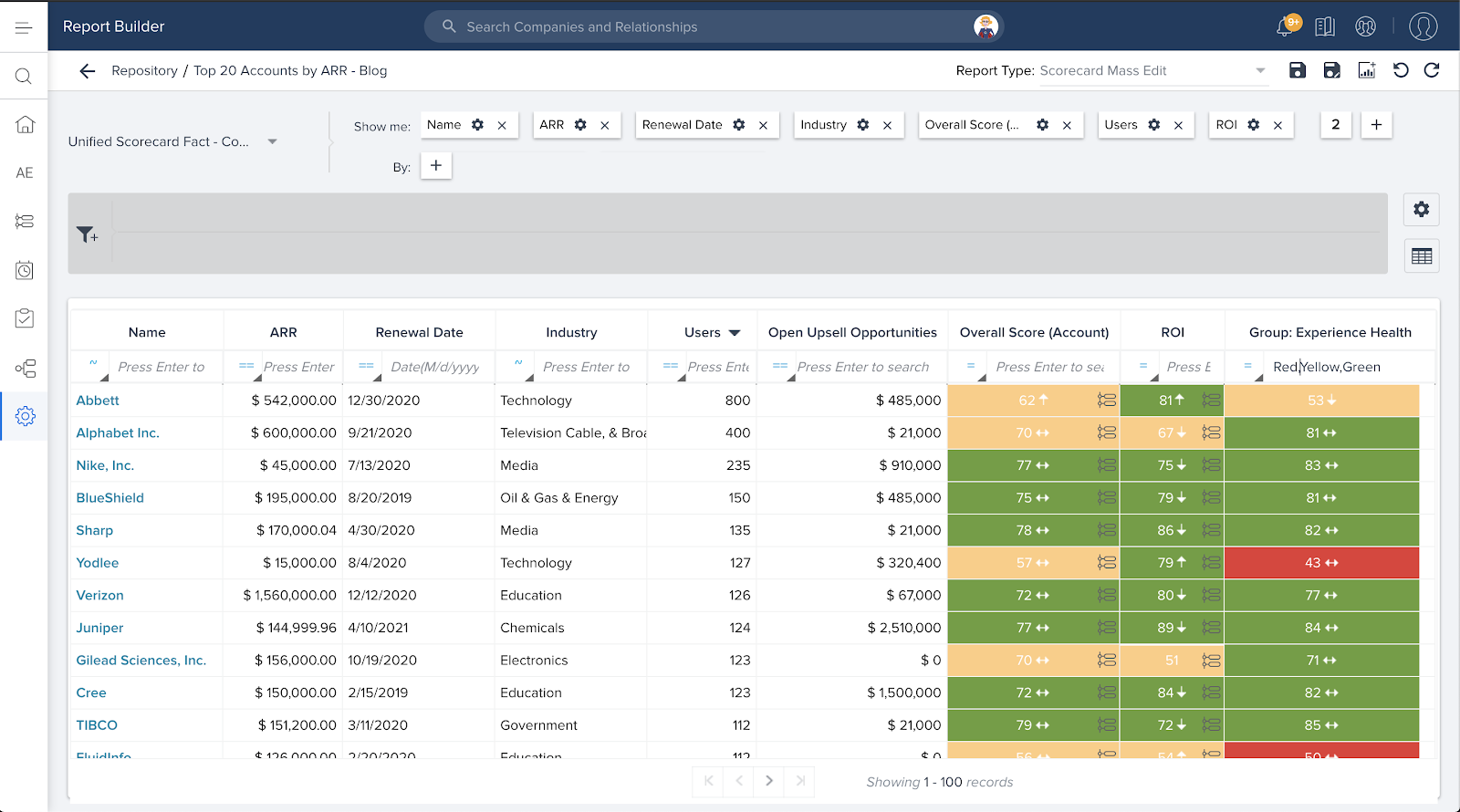

6. Determine Expansion Opportunity

Customer Success isn’t only about the downside. Our CCO, Ashvin, outlined a data-driven methodology for identifying where you might have opportunity to drive expansion. Through this careful analysis, you’ll identify:

- Clients that are using more than they purchased

- Clients that have chance to buy new modules

Plug in your estimate of how much you can expand some of your “green” clients. Open upsell opportunities can be a good indicator of areas to focus.

All data shown is sample data.

7. Standardize Your Playbook For Negotiating

As you contemplate the retention strategy for each customer, consider your negotiating strategy as well. How can you maximize terms that create “win-win” situations for the client and you. If you have a stronger balance sheet, perhaps you can push payment terms out. Rather than having a client churn altogether, maybe you can give them three months free. Instead of making these one-off decisions, give your team a “menu” of options from which to work.

8. Use the Data Above To Build Your Projection

Using all of the data above, you can then build a projection model:

- Category 1 companies may churn at a high rate no matter what.

- Category 2 companies might churn at higher rates than normal if usage, health, and outcomes are not green. But otherwise, they will behave as normal.

- Category 3 companies might retain at the same amount, but might also be more likely to grow, driving Net Retention Rate performance.

9. Swarm Your At-Risk Clients

All of this is still theory and measurement. What we’re missing is how you can influence the outcome. For Category 1 businesses, your impact may be limited. But if you can turn the “Yellow” customers in Category 2 to “Green,” you have a ton of upside in your model.

So how can you “swarm” these customers? If new sales are slow, can you have Account Executives rotate into Customer Success Management for a while? Can you redirect idle Professional Services teammates to help the cause?

If you do this, make sure your team has tools and approaches to keep everyone on the same page or you’ll make the client experience even worse.

10. Leverage Tech Touch for Your Long Tail

You likely have clients that you can’t reach in the high touch model above. But do you really want to ignore them? In a downturn, customers that are ignored are ones that walk away. How can you use technology to engage with them and then be available for them when they need help?

Many companies use a combination of email and in-product communications to stay in touch with their smaller customers. Not to spoil the surprise for the tenth point, but these communications are more delicate than ever—especially for your Category 1 customers. How you use your one-to-many and in-app channels requires a great deal of tact and empathy—take a look at Ashvin’s best practices for crisis communications to get some highly actionable tips.

Bonus: Above All Else, Show Empathy

Finally, through all of this, demonstrate compassion for your customers. You’re going through a lot right now—and they’re in the same boat. We’re not just talking about the company—it starts at a human level. We wrote about some positive things we can all do amidst the crisis, and living the Golden Rule was first on my list. One thing in particular that makes a huge difference is if your client is firm on leaving, let them go in a classy way. Make sure you preserve the relationship. Because most likely, they will be back.

And that takes us back to the beginning. In recurring revenue business, the revenue indeed does recur—but only if you make it so. Good luck.